| 🏛️ Based in | Limassol, Cyprus |

|---|---|

| ⚖️ Regulation | CySEC, FSA |

| 💰 Minimum Deposit | $5 |

| 💳 Deposit Options | VISA, MasterCard, Bank Wire, Skrill, Neteller, or Webmoney. |

| 💳 Withdrawal Options | VISA, MasterCard, Bank Wire, Skrill, Neteller, or Webmoney. |

| 📌Open an account | Start Trading with easyMarkets |

Contents

- 1 Our Opinion About easyMarkets

- 2 Key Benefits

- 3 Regulation

- 4 Regulation in Kenya

- 5 Client Fund Safety

- 6 Forex Trading Awards

- 7 easyMarkets: Legit Or Scam?

- 8 Trading Assets

- 9 Trading Instruments

- 10 easyMarkets Account Types

- 11 Standard Account

- 12 Premium Account

- 13 VIP Account

- 14 Islamic Swap-Free Accounts

- 15 Commission, Spreads and Leverage

- 16 easyMarkets Registration – How To Open A Trading Account

- 17 Deposits & Withdrawals

- 18 easyMarkets Trading Platforms

- 19 Trading Tools

- 20 Education

- 21 easyMarkets Customer Support

- 22 Our Verdict

- 23 easyMarkets Forex Broker Review FAQ

- 24 Similar Brokers

Our Opinion About easyMarkets

easyMarkets has established itself as a prominent forex broker, providing online trading services to a global clientele for many years. The company’s credibility is underscored by its registration with reputable financial authorities, including ASIC and CySEC, ensuring a regulated and secure trading environment with robust client fund protection. easyMarkets stands out for its excellent trading conditions and transparent pricing structure.

With over 170 trading instruments spanning forex, shares, indices, cryptocurrencies, and commodities, the broker caters to diverse trading preferences. They offer three distinct account types, each featuring competitive commissions, favorable spreads, and swift trade execution. Traders can choose between two industry-leading platforms: MetaTrader4 and MetaTrader5.

Key Benefits

Regulation

easyMarkets is a regulated broker. It is licensed by the Australian Financial Services. It is also licensed by the Cyprus Securities & Exchange Commission (CySEC), the Financial Services Authority of Seychelles (FSA), and the Financial Services Commission (FSC). Here are their licence numbers:

- Australia – Australian Financial Services (No. 246566).

- Cyprus – Cyprus Securities & Exchange Commission (No. 079/07)

- Seychelles – Financial Services Authority of Seychelles (No. SD056)

- British Virgin Islands – Financial Services Commission (No. SIBA/L/20/1135).

Regulation in Kenya

Traders in Kenya can open a trading account under easyMarkets’ EF Worldwide branch, which is regulated by the FSC in the British Virgin Islands. As an FSC-regulated branch, EF Worldwide operates with slightly less regulatory oversight than the others. However, easyMarkets is a very reliable brand and they implement client fund safety protocols across all their business branches.

Client Fund Safety

As a regulated broker, easyMarkets offers a high level of client fund protection. It uses segregated accounts. This means that its clients’ funds and its operational funds are kept in separate accounts. As such, clients’ funds are never used for operational purposes.

As a responsible broker, easyMarkets also offers a high level of data security. easyMarkets employs secure encryption technology for data transfers between its servers and clients’ computers as well as advanced firewalls which protect its systems against malicious attacks or unauthorized access attempts from outside sources. It also ensures customer accounts are protected with two factor authentication (2FA). This means that customers are required to enter an additional code when logging in or making changes on their account settings page – adding another layer security against potential hackers gaining access into your account without permission.

Finally, easyMarkets has implemented a strict anti money laundering policy requiring customers provide proof identity documents before being able deposit/withdraw funds – these must be verified by one their compliance officers before transactions can be processed successfully. This ensures funds are always sent to and from the correct accounts.

Forex Trading Awards

- Best Cryptocurrency Innovation UAE 2022 – Finance Derivative Magazine

- Most Trusted Broker 2022 – Smart Vision Investment Expo Egypt

- Most Reputable Multi-Asset Broker 2022 – Forex Expo Dubai

- Most Trusted Forex Broker in Middle East 2022 – Fin Expo Egypt 2022

- Best Forex Trading Innovation 2022 – FxScouts.com

easyMarkets: Legit Or Scam?

easyMarkets is a legit forex broker. They are a popular online trading provider that offers easy access to the global currency markets. They have been in business since 2001 and are regulated by multiple financial authorities, including the Cyprus Securities and Exchange Commission (CySEC). easyMarkets also offers great trading accounts. They have user-friendly platforms, competitive spreads, low fees and wide range of trading tools. As such, we feel they are definitely legit.

Trading Assets

easyMarkets offers 190+ trading instruments across several asset classes. You can trade forex pairs, indices, oil, gas, metals, agricultural commodities, and cryptocurrencies.

Trading Instruments

- Forex: They have 100+ instruments, including major, minor, and exotic pairs.

- Share CFDs: They have 50 share CFDs for major US, EU, and AU companies.

- Precious metals: They have 19 precious metal CFDs including platinum.

- Indices: They have 15 indice CFDs for major UK, US, and EU markets.

- Commodities: They have 12 commodities including metals, energies, and cotton.

- Cryptocurrencies: They have 6 cryptocurrencies including Bitcoin

easyMarkets Account Types

easyMarkets has three account options: the Standard Account, Premium Account, and VIP Account.

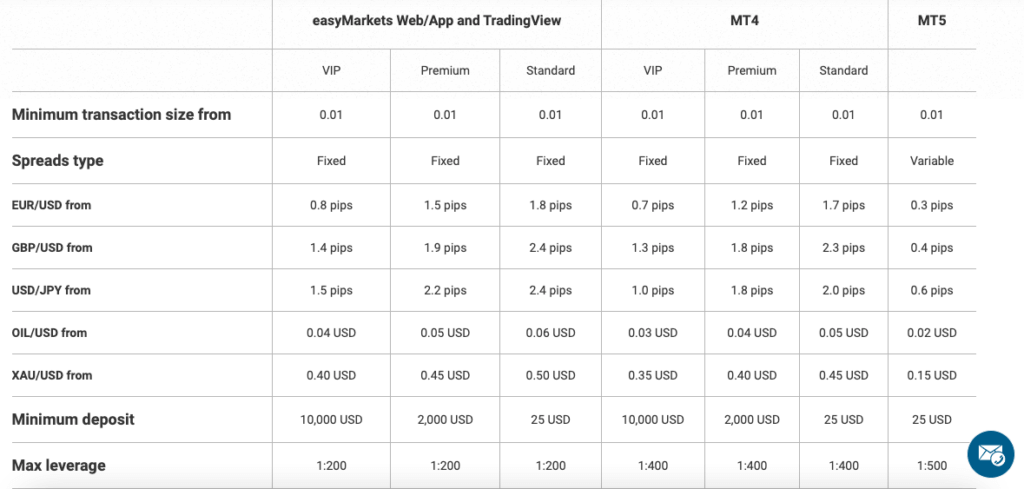

Standard Account

- Minimum Deposit: $25

- Spreads: From 1.8 pips (WebTrader) or 1.7 pips (MT4)

- Commissions: No commission

- Leverage: Up to 1:500

- Ideal for: Beginner traders or those with limited capital

Premium Account

- Minimum Deposit: $2,000

- Spreads: From 1.5 pips (WebTrader) or 1.2 pips (MT4)

- Commissions: No commission

- Leverage: Up to 1:500

- Ideal for: Intermediate traders with more capital and experience

VIP Account

- Minimum Deposit: $10,000

- Spreads: From 0.8 pips (WebTrader) or 0.7 pips (MT4)

- Commissions: No commission

- Leverage: Up to 1:500

- Ideal for: Experienced traders with significant capital

Each account type is available on both the proprietary easyMarkets WebTrader platform and the popular MetaTrader 4 (MT4) platform, giving traders flexibility in their choice of trading interface.

Islamic Swap-Free Accounts

All of the easyMarkets accounts are available as Islamic Accounts, and you can choose this option when opening your online trading account. The Islamic Account option allows traders who follow Sharia Law to trade without incurring interest charges or swap points when holding positions overnight – this makes it ideal for long-term traders looking for cost effective ways to manage their portfolio over time while adhering strictly religious beliefs regarding finance transactions.

Commission, Spreads and Leverage

easyMarkets has tight spreads. The spread available depends on what account type you choose. For example, you can get spreads from 0.8 pips on EUR/USD on the VIP account, and from 1.5 pips on EUR/USD on the Premium account. There are no commission charges on any of the accounts. easyMarkets have variable leverage. For example, you can get 1:20 on stocks and cryptocurrencies, 1:100 on indices and commodities, and 1:500 on forex and metals.

easyMarkets Registration – How To Open A Trading Account

As part of our easyMarkets broker review, we checked their online registration process. If you live in Kenya, then you are eligible to open a forex trading account.

- Go to the easyMarkets website.

- Fill in the online registration form.

- Choose your login details.

- Take a quick forex trading quiz to assess your knowledge.

- Complete the account verification process.

- Send copies of the requested documents. Choose your trading account type.

Deposits & Withdrawals

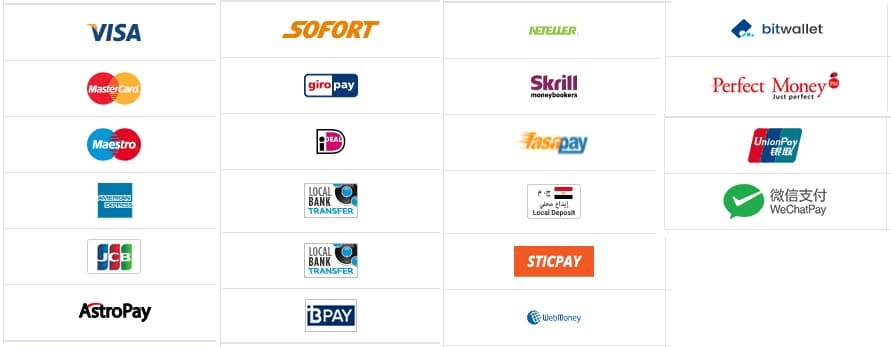

easyMarkets offers many different payment methods including debit card, credit card, bank transfer, Skrill, Neteller, or Webmoney. They have good deposit times and no deposit fees. You can also withdraw money using any of these payment methods. They have fast withdrawal times and low withdrawal fees.

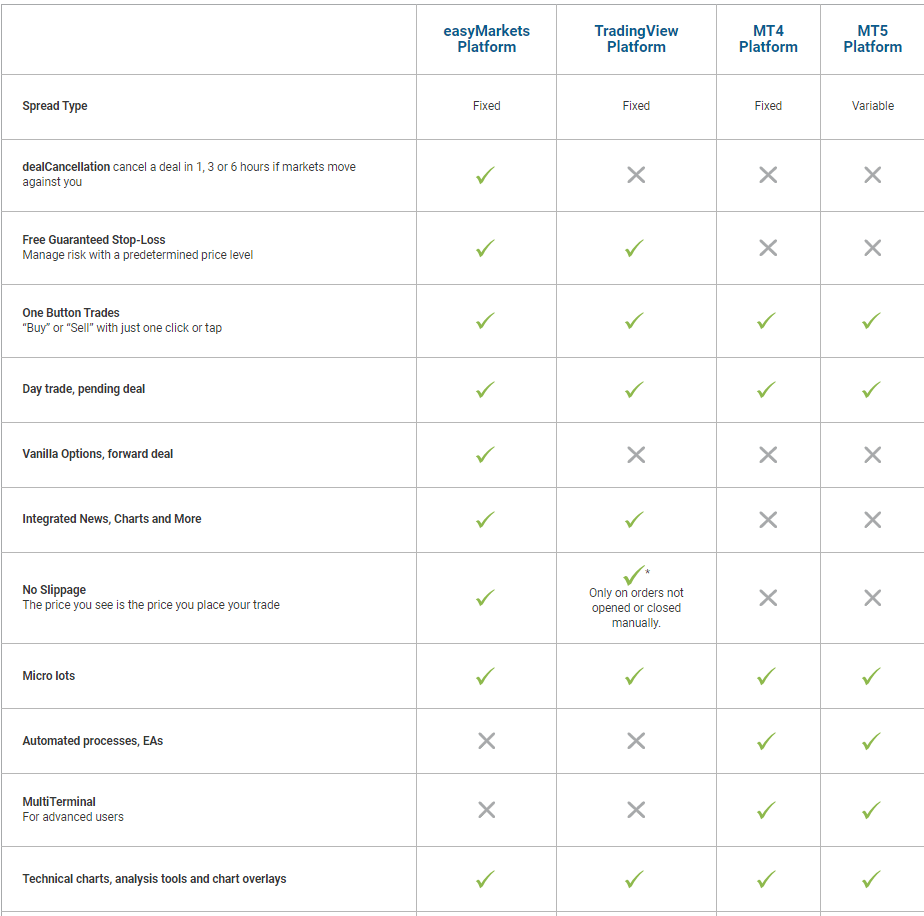

easyMarkets Trading Platforms

easyMarkets offers trading on both MetaTrader4 and MetaTrader5. These platforms are free to download and use. They are also available on multiple devices including desktop, tablet and mobile. This means you can trade anywhere, anytime, as long as you have an internet connection.

The best trading platform for new forex traders is MetaTrader4 (MT4). The easyMarkets MT4 platform is an easy-to-use platform and suitable for forex trading. The platform provides you with access to a range of currency pairs and other financial instruments, including commodities, indices and stocks. It also features advanced charting tools, automated trading systems and more.

The best trading platform for intermediate traders in MetaTrader5. The easyMarkets MT5 platform has an nice design and many built-in trading tools. You access and trade all of your favourite markets including forex, shares, and crypto. It is very easy to navigate. The platform also has many great features including 6 order execution types, 38 indicators, and 37 analytical objects.

Trading Tools

easyMarkets has some great trading tools, including easyTrade and Freeze rate tools. The easyTrade tool helps you plan your trades and lets you set a maximum amount of risk for each position. As such, it helps you better manage your exposure and limit your potential losses. Meanwhile, the Freeze Rate tool lets you freeze the price you see and gives you a buffer of a few seconds to perform your trade. As such, it helps you better manage your risk during times of high market volatility.

Education

easyMarkets offers many helpful resources including educational articles, detailed eBooks, helpful glossaries, and a free trading course. The trading course covers many important topics including market analysis, trading plans, risk management, and trading psychology. As such, it provides you with a solid education and a good introduction to forex trading.

easyMarkets Customer Support

At easyMarkets, they understand that customer support is an essential part of any successful forex trading experience. That’s why they provide a comprehensive range of services to ensure their customers have the best possible experience when trading with them. Their customer service team is available 24/7 and can be contacted via email, telephone or live chat.

Our Verdict

easyMarkets has a great all-round package. It offers excellent trading conditions, great trading platforms, and a secure trading environment. It also has good educational resources and a helpful customer support team.

easyMarkets Forex Broker Review FAQ

Yes, easyMarkets is a legit forex broker. They are an established and regulated online trading service provider. easyMarkets has a very strong account offering.

Yes, easyMarkets is a regulated forex broker. Forex traders in Kenya will come under their FSC business entity.

Yes, you can trust easyMarkets. They are one of the most well-known forex brokers in the industry, and one of the most popular online trading companies operating in Kenya.

Yes, easyMarkets charges very competitive spreads compared with other brokers so your costs will be kept low when making trades.

The minimum deposit required varies depending on which type of account you choose. The lowest minimum deposit is $25, and that’s for the Standard Account.

easyMarkets is a safe forex broker. When it comes to fund safety, they choose to go beyond their basic regulatory requirements, and offer more comprehensive client fund protection measures.

The platform is designed with both beginner and experienced traders in mind. They offer user-friendly tools such as guaranteed stop loss orders (GSLOs), negative balance protection (NBP) .

Like what you see? Sign up for an online trading account with easyMarkets.