Are you looking for a robust and easy-to-use trading platform? Then MetaTrader 4 (MT4) is the answer. Due to its extensive functionalities and user-friendly nature, millions of traders worldwide have made this platform their number-one choice.

In this detailed guide, you will acquire immense knowledge of MT4 and all the essential features that remain a common preference amongst traders globally. We will also guide you on how to start trading with MT4 brokers in Kenya. Therefore, this will be an excellent opportunity to enter the trading industry effortlessly.

Contents

- 1 MetaTrader 4 (MT4) Forex Brokers List

- 2 What is MetaTrader 4?

- 3 The History of MT4

- 4 Accessing MT4 Through MT4 Brokers

- 5 Benefits of Using the MT4 Platform

- 6 Expert Advisors (EAs) Explained

- 7 MT4 Indicators for Technical Analysis

- 8 Getting Started with MT4 in Kenya

- 9 Step 1: Choose a Regulated MT4 Broker

- 10 Step 2: Open a Demo Account

- 11 Step 3: Fund Your Live Account

- 12 Step 4: Download MT4

- 13 Step 5: Explore the Platform

- 14 Step 6: Develop a Trading Plan

- 15 Tips for Successful Trading on MT4

- 16 MT4 Brokers in Kenya

- 17 1. Pepperstone

- 18 2. HF Markets

- 19 The Future of MT4

MetaTrader 4 (MT4) Forex Brokers List

Broker | Features | Broker Review | Visit |

* CMA regulated * 1:1000 leverage * 1200+ instruments | |||

* CMA regulated * $200 min. deposit | |||

* CMA regulated * 1:400 leverage * $5 min, deposit | |||

* 1:1000 leverage * 950+ instruments * Copy trading | |||

* 1:1000 leverage * 210+ instruments * Free education | |||

* 1:500 leverage | |||

* 1:500 leverage | |||

* 1:500 leverage | |||

*1:500 leverage | |||

* 1:500 leverage * 390 instruments * Tight spreads | |||

* Cryptotrading | |||

* Low minimum deposit | |||

* 1:500 leverage * 300+ instruments * Low minimum deposit | |||

* 1:777 leverage | |||

* 1:500 leverage * 800+ instruments * African Broker | |||

* 1:1000 leverage | |||

* 1:1000 leverage | |||

* 1:1000 leverage |

What is MetaTrader 4?

MT4 is a popular trading software developed by MetaQuotes Software. It’s packed with features to help you trade like a pro:

- Intuitive interface that’s easy to navigate

- Advanced charting with 100+ technical indicators

- One-click trading right from the charts

- Automated trading using Expert Advisors (EAs)

- Available on desktop, web, and mobile

With MT4, you can trade forex, CFDs, stocks, and more, all from one platform. How cool is that?

The History of MT4

MT4 was first released in 2005 by MetaQuotes Software. It quickly gained popularity among retail traders for its user-friendly interface and advanced features. Over the years, MT4 has become the industry standard for forex and CFD trading. It’s used by millions of traders and offered by hundreds of brokers worldwide. In 2010, MetaQuotes released MT5, the successor to MT4. While MT5 has additional features, MT4 remains the platform for most traders.

Accessing MT4 Through MT4 Brokers

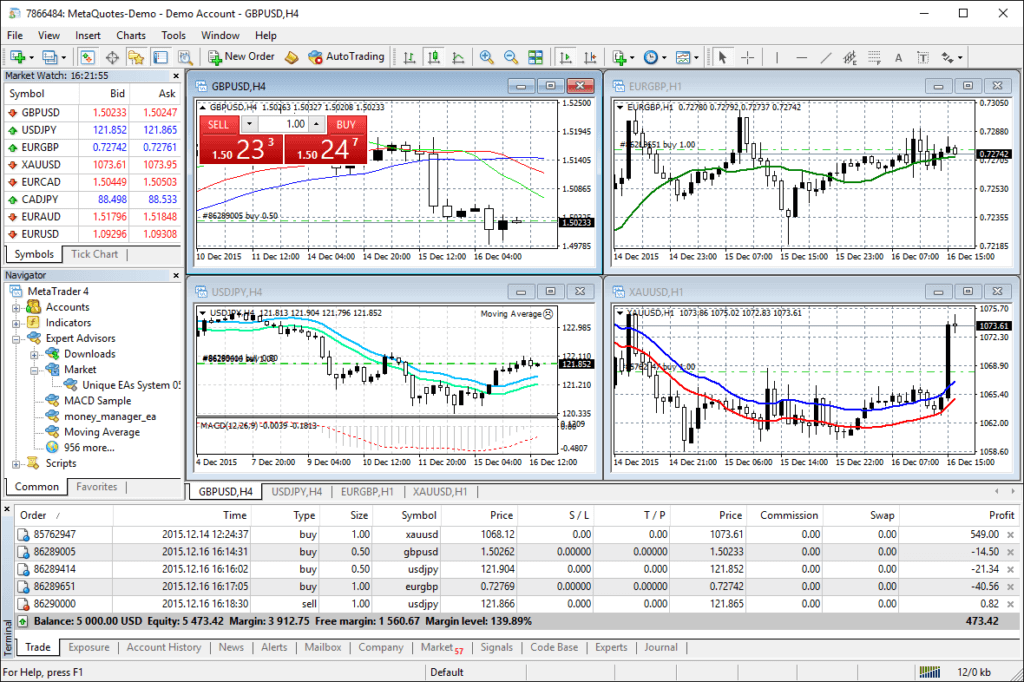

To use MT4, you must open an account with an MT4 broker. They provide the platform and process your trades. When you place trades on MT4, the orders get sent to your broker. They match you with liquidity providers to fill your orders at competitive prices. Your broker also provides the leverage for your trades. In Kenya, the maximum leverage is usually 1:400. You can trade with 400 times your account balance. Here is what your MT4 should look like;

Benefits of Using the MT4 Platform

So why should you use MT4 for your trading? Here are some key benefits:

- Customization: Tailor the platform to your preferences. Customize chart setups, place trades your way, and automate strategies. Make it your own!

- Ease of Use: MT4 is user-friendly and intuitive. The interface is clean and easy to navigate. Perfect for both beginners and advanced traders.

- Charting Power: Access advanced charting features to analyze price action. Choose from 100+ built-in indicators and drawing tools. Spot those trading opportunities!

- Automated Trading: Use Expert Advisors (EAs) to automate your strategies. Test them riskfree with backtesting. Harness the power of algorithmic trading.

- Mobile Trading: Trade on the go with the MT4 mobile apps, available for iOS and Android. Never miss a trade again!

- Large Community: MT4 has a massive global community of traders and developers. You can access countless resources, EAs, and custom indicators and learn from fellow traders.

- Multilingual Support: MT4 supports over 30 languages, including English and Swahili. Trade in your preferred language.

- Stability and Speed: MT4 is known for its stability and fast execution speeds. Enjoy reliable trading even during high market volatility.

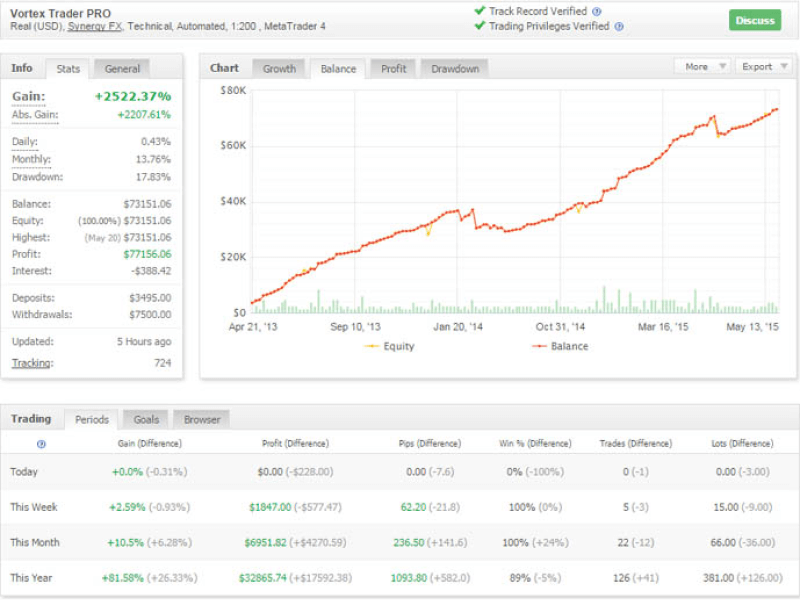

Expert Advisors (EAs) Explained

EAs are programs that run automated strategies on MT4. They scan the markets 24/5 and execute trades based on your predefined rules. With the MQL4 programming language, you can code your EAs from scratch. Or use the strategy tester to backtest EAs on historical data. Finetune them before going live. The possibilities with EAs are endless. From simple trend-following systems to complex algorithms, automate whatever fits your style.

Some popular types of EAs include:

- Scalping EAs that make numerous small trades

- Trend following EAs that ride market trends

- News trading EAs that react to economic events

- Arbitrage EAs that exploit price discrepancies

Of course, no EA is perfect. Understanding the risks involved and using proper risk management is important. Always monitor your EAs and intervene if necessary.

MT4 Indicators for Technical Analysis

MT4 comes with a wide range of built-in technical indicators. These are mathematical calculations that analyze price and volume data. Indicators help you identify trends, momentum, and potential entry/exit points. They’re an essential tool for many technical traders.

Some popular MT4 indicators include:

- Moving Averages (MA)

- Relative Strength Index (RSI)

- Moving Average Convergence Divergence (MACD)

- Bollinger Bands

- Stochastic Oscillator

You can access these indicators from the ‘Insert’ menu in the MT4 platform. Apply them to your charts and customize their settings as needed. MT4 also supports custom indicators. These are indicators created by third-party developers or the MT4 community. You can download and install them to expand your analysis toolset.

Getting Started with MT4 in Kenya

Ready to start using MT4 in Kenya? Follow these steps:

Step 1: Choose a Regulated MT4 Broker

Select a reputable MT4 broker regulated by the Capital Markets Authority (CMA) or other major jurisdictions. Look for brokers that offer competitive spreads, fast execution, and local support.

Step 2: Open a Demo Account

Most MT4 brokers offer free demo accounts. This opportunity will test the MT4 platform and the broker’s trading conditions without risk.

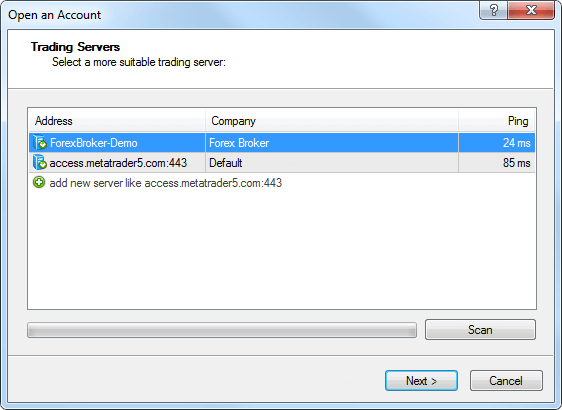

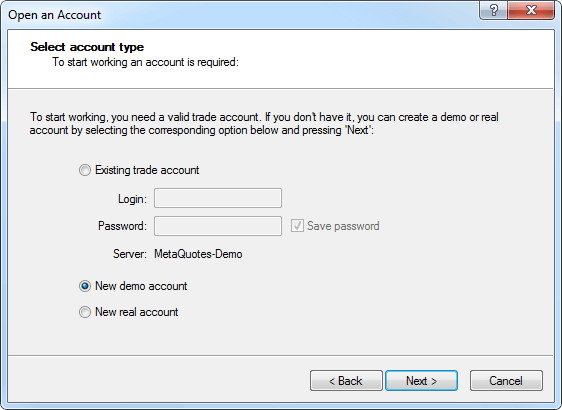

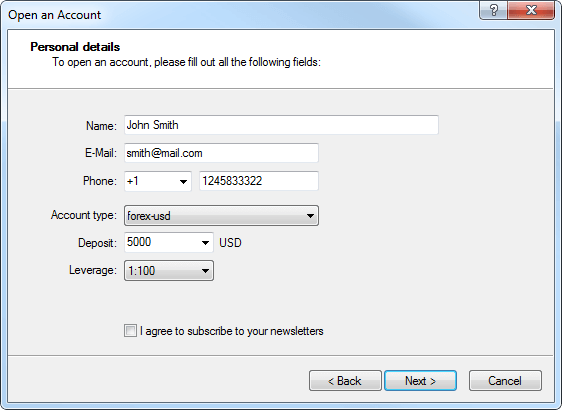

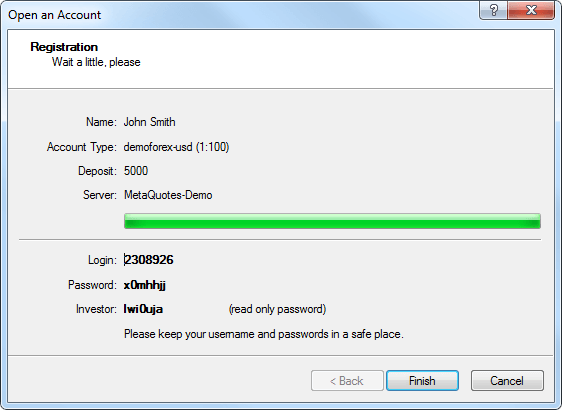

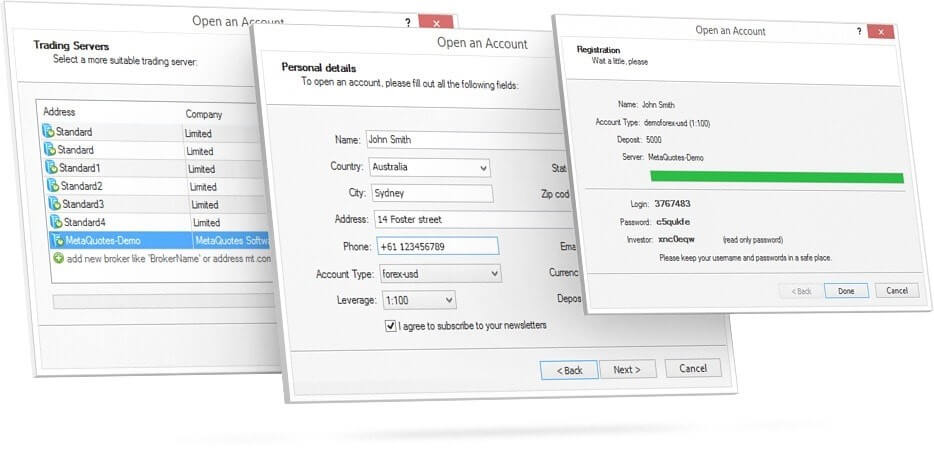

To open a demo account, follow these steps:

- Select “File” → “Open an Account” from the menu or right-click on “Accounts” in the Navigator window and choose “Open an Account”.

- Choose a server with the lowest ping for optimal performance.

- Select “New demo account” and click “Next.”

- Fill in your details, and choose your preferred account type, deposit amount, currency, and leverage.

- Agree to subscribe to the broker’s newsletters and click “Next.”

- Upon successful registration, you will see your account details, including login, password, and investor password.

Your new demo account is ready to use and will appear in the “Navigator – Accounts” window.

Step 3: Fund Your Live Account

Create and fund a live account when you feel confident with your trading skills. Brokers typically support bank transfers, M-Pesa, and credit/debit cards.

Note: Under specific terms and conditions, brokerage companies can only open real accounts. Once opened, they will be marked accordingly in the “Navigator – Accounts” window.

Step 4: Download MT4

Install the MT4 software on your device. Log in using the credentials provided by your broker. You’re now ready to start trading!

Step 5: Explore the Platform

Take some time to familiarize yourself with MT4’s features:

- Customize charts to your preferences

- Explore the Market Watch to view available instruments

- Set up trade defaults to streamline your trading process

Step 6: Develop a Trading Plan

Before diving into live trading, it’s crucial to develop a solid trading plan:

- Define your trading goals

- Establish risk management rules

- Determine your trading strategies

Please stick to your plan and refine it as you gain more experience.

Tips for Successful Trading on MT4

To make the most of MT4 and improve your trading results, consider these tips:

- Learn the Basics: Before diving into live trading, learn the basics of forex and CFD trading. Understand key concepts like pips, lots, and margins.

- Start with Demo Trading: Use a demo account to familiarize yourself with MT4 and test strategies risk-free. Only switch to live trading when consistently profitable.

- Keep a Trading Journal: Record your trades, including entry/exit points, position sizes, and emotions. Review your journal regularly to identify strengths and weaknesses.

- Use Risk Management: Always use stoplosses to limit potential losses. Risk only a small percentage of your account on each trade. Avoid overleveraging.

- Continuously Educate Yourself: Learn about trading strategies, market analysis, and MT4 features. Read books, attend webinars, and join trading communities.

MT4 Brokers in Kenya

To help you get started, our team at TradeForexke has reviewed and selected two popular MT4 brokers in Kenya:

1. Pepperstone

Pepperstone is a well-established MT4 broker regulated by major authorities like CMA. They offer competitive trading conditions, including:

- Low minimum deposit of $200

- Leverage up to 1:1000

- Access to 1200+ trading instruments

With fast execution and responsive customer support, Pepperstone is a solid choice for Kenyan traders.

2. HF Markets

HFM is another reputable broker offering:

- CMA regulation for the safety of funds

- Leverage up to 1:1000

- Wide range of 1200+ instruments

- Helpful educational resources

HFM provides a user-friendly MT4 platform with advanced features suitable for beginner and experienced traders.

Both Pepperstone and HFM are regulated by CMA, ensuring the safety and security of your funds. They offer competitive spreads, high leverage, and diverse trading instruments. Of course, there are many other MT4 brokers to choose from. We encourage you to research and compare factors like regulation, trading conditions, account types, and educational resources to find the best fit for your needs.

The Future of MT4

As technology progresses, MT4 continually changes to match traders’ new demands. MetaQuotes launches regular updates to enhance the platform’s convenience and security. A notable trend in recent years has been the rapid growth of mobile trading. The already-known MT4 mobile apps for iOS and Android devices will soon have even more functionality and a better user interface. An equally important factor is the development of algorithmic trading.

With the help of EAs and custom indicators, more and more traders are automating their strategies globally. That is why the MT4 developer community will also grow and develop. Thus, these are the beginning days of trading, and MT4 is opening all the new features. Given its ability to adapt to new markets and technologies, the platform will remain the number one choice for users worldwide.

So, what are you waiting for? Start your MT4 journey today and join the ranks of successful Kenyan traders. The markets await you!

To your trading success!