Contents

- 1 StarTrader Basics

- 2 Star Trader Forex Broker – Fact Sheet

- 3 Pros

- 4 Cons

- 5 Our Opinion About StarTrader

- 6 StarTrader’s Core Offerings

- 7 Trading Platforms and Tools

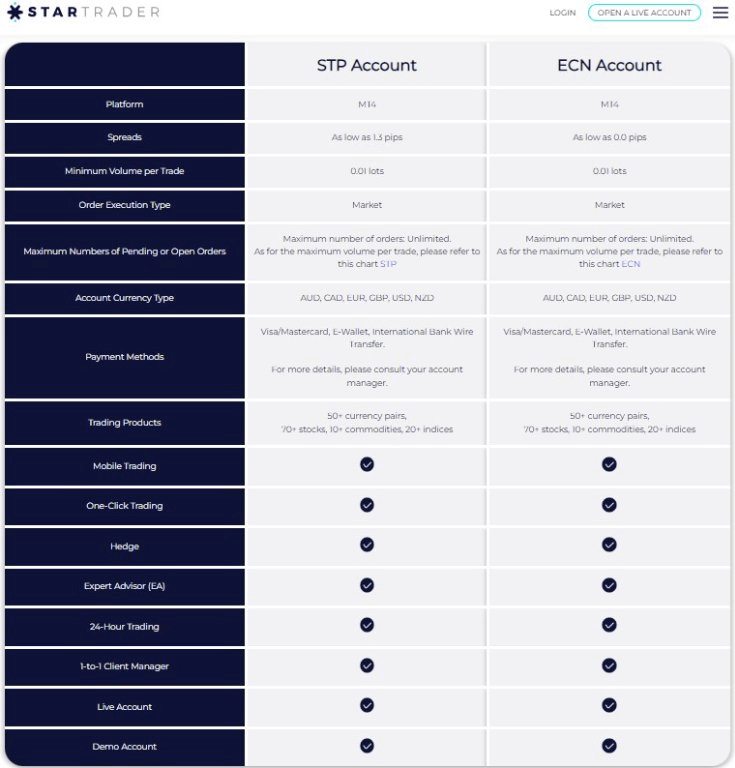

- 8 Account Types and Terms

- 9 Fee Structure and Costs

- 10 Deposits and Withdrawals

- 11 Customer Support

- 12 Regulatory Environment and Safety

- 13 Research and Education

- 14 Who Is StarTrader Best For?

- 15 What to Consider Before Trading With StarTrader

- 16 Our Verdict

- 17 Broker Reviews

StarTrader Basics

| 🏛️ Based in | Saint Vincent and Grenadines |

|---|---|

| ⚖️ Regulation | SVG |

| 💰 Minimum Deposit | $50 |

| 💳 Deposit Options | Crypto, VISA, MasterCard, Bank Wire, SticPay, PM, Skrill, Neteller |

| 💳 Withdrawal Options | Crypto, VISA, MasterCard, Bank Wire, SticPay, PM, Skrill, Neteller |

| 📌Open an account | Start Trading With StarTrader |

Star Trader Forex Broker – Fact Sheet

| Feature | Details |

|---|---|

| Broker Name | Star Trader |

| Regulation | Regulated by Major Financial Authorities |

| Minimum Deposit | $100 |

| Maximum Leverage | Up to 1:500 |

| Trading Instruments | Forex, Commodities, Indices, Cryptocurrencies |

| Platforms | MT4, MT5, WebTrader |

| Spread Type | Variable (as low as 0.0 pips) |

Pros

- Regulated by reputable authorities

- Competitive spreads

- Variety of trading instruments

- Multiple trading platforms

Cons

- Not available to residents of certain countries

- Some withdrawal methods incur fees

Our Opinion About StarTrader

StarTrader is a new forex broker that was launched in 2019. They are a regulated company with a registration in St Vincent and Grenadines. They are one of the fast-growing forex brokers in the industry. StarTrader is known for placing a high value on transparency, reliability, and security. And they have already won several awards in recognition of the high standard of service they offer to clients in Africa.

As a regulated forex broker, StarTrader offers great online trading conditions. They offer you access to over hundreds of trading instruments including forex, metals, shares, indices, and commodities. They also offer a nice choice of StarTrader trading accounts. There are two main account options – both of which come with low commissions, tight spreads, and ultra-fast trade execution. You can also choose from some best online trading platforms – including MetaTrader4 and MetaTrader5.

If you’re looking for great support, StarTrader would be a good choice. They offer a nice range of tools including trading calculators, market analysis tools, and VPS services. They also provide a good selection of payment methods, for quick hassle-free. And if you’re looking for good customer service then you’ll be pleased to know that StarTrader also provides multilingual support.

StarTrader’s Core Offerings

StarTrader provides access to an impressive selection of over 850 financial instruments, spanning forex pairs, stocks, indices, commodities, cryptocurrencies, and ETFs. Traders have the flexibility to choose from two primary account types: a standard account that offers zero commissions but slightly higher spreads, and an ECN account that features tighter spreads with a small commission fee. Both accounts require a modest minimum deposit of just $50, making the broker accessible to beginners and experienced traders alike.

Another point worth noting is the range of supported languages. StarTrader’s platforms and customer support cater to clients worldwide by offering services in English, French, Spanish, Chinese, Malay, Japanese, Thai, and Arabic. This broad linguistic support highlights the broker’s commitment to serving a diverse global client base.

Trading Platforms and Tools

When it comes to technology, StarTrader delivers with the well-known MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are available on both desktop and mobile devices, ensuring that traders can stay connected and execute trades from anywhere. MT4 and MT5 are particularly popular for their extensive analytical tools, built-in algorithmic trading capabilities, and customizable charts.

Additionally, StarTrader has integrated advanced features such as one-click trading, custom watchlists, and an alert system that notifies traders when certain price levels are reached. The inclusion of a VPS hosting option is another standout feature. By reducing latency, the VPS hosting allows traders—particularly scalpers and algorithmic traders—to benefit from faster execution speeds and more reliable performance.

Account Types and Terms

StarTrader’s Standard account is ideal for those who prefer a straightforward trading experience without commissions. This account offers spreads starting from 1.3 pips and is suitable for beginners or casual traders.

On the other hand, the ECN account is geared toward more advanced traders who need access to tighter spreads, starting from 0.0 pips, in exchange for a $7 commission per lot. Both accounts provide leverage of up to 1:500, a competitive offering that can appeal to traders looking to optimize their position sizing.

It’s also worth mentioning that StarTrader supports Islamic accounts, allowing traders to adhere to Shariah-compliant trading practices by eliminating swap fees.

Fee Structure and Costs

One of the key attractions of StarTrader is its fee structure. The broker keeps trading costs competitive, with spreads generally falling below or near industry averages on most assets.

For instance, spreads on popular forex pairs such as EUR/USD range from 1.2 to 1.4 pips. Other assets, including commodities like gold, indices like the DAX, and major cryptocurrencies, show favorable costs compared to many competitors.

Swap fees—costs incurred for holding positions overnight—are slightly higher than average in some cases. For example, EUR/USD positions might carry a $6.47 swap long fee, but traders can still find opportunities for cost-effective trading by strategically managing their positions. Importantly, StarTrader does not charge any inactivity fees, ensuring that dormant accounts don’t lose funds over time.

Deposits and Withdrawals

When it comes to funding your account, StarTrader offers a range of convenient options. Traders can choose from traditional bank transfers, credit and debit cards, popular e-wallets like Skrill and Neteller, and even cryptocurrencies.

Processing times for most deposit methods are nearly instant, while withdrawals through e-wallets and crypto are typically completed within one business day. For those using wire transfers, expect a wait of up to five business days.

The broker doesn’t impose any additional fees on deposits or withdrawals, a feature that sets it apart from many competitors.

Customer Support

In the realm of customer service, StarTrader provides multiple channels of support. Traders can reach out via email or live chat, available 24/5. While the broker doesn’t offer phone support, the live chat agents are responsive and knowledgeable, often resolving common inquiries within minutes.

The company’s support team covers a wide range of languages, enabling effective communication for clients from various regions. Overall, while StarTrader’s customer support isn’t the most comprehensive in the industry, it’s reliable and accessible enough to address most issues.

Regulatory Environment and Safety

A critical aspect of any broker review is assessing the company’s regulatory status. StarTrader operates through several entities worldwide. In Australia, it’s licensed by the Australian Securities and Investments Commission (ASIC), a Tier-1 regulatory body known for its stringent oversight. Other entities are regulated by the Financial Services Commission (FSC) of Mauritius and the Financial Services Authority (FSA) of Seychelles, both Tier-3 regulators.

StarTrader also ensures client funds are kept in segregated accounts, meaning your trading capital is held separately from the company’s operational funds. Negative balance protection is provided as well, preventing traders from losing more than their account balance.

However, it’s important to note that not all of StarTrader’s entities are regulated. Some offshore registrations do not offer the same level of regulatory oversight as Tier-1 or Tier-2 regulators. This disparity means that clients should carefully choose which entity they open an account under, based on their risk tolerance and regulatory preferences.

Research and Education

While StarTrader provides a solid foundation of educational materials—such as basic trading guides, articles on technical analysis, and archived webinars—its research offerings are somewhat limited. The broker publishes daily market updates and technical analyses, but the depth of these reports may not satisfy advanced traders seeking more comprehensive research tools.

For novice traders, the educational resources can be a helpful starting point. More seasoned market participants, however, might need to supplement StarTrader’s materials with external research and analysis tools.

Who Is StarTrader Best For?

- Casual Traders: With its low minimum deposit and user-friendly platforms, StarTrader caters well to casual traders looking for a straightforward experience.

- Scalpers and Algorithmic Traders: The availability of VPS hosting, tight spreads, and fast execution times makes StarTrader a strong choice for scalpers and those running automated strategies.

- Social and Copy Traders: StarTrader’s proprietary platform for copy trading allows signal providers and followers to easily connect, making it an appealing option for those who prefer a collaborative trading approach.

- Swing Traders: The variety of tradable instruments, combined with reasonable swap fees, provides swing traders with opportunities to hold positions over longer timeframes.

What to Consider Before Trading With StarTrader

While StarTrader has many strengths, there are a few drawbacks to keep in mind. First, the lack of in-depth research tools may limit its appeal for traders who rely heavily on data-driven insights. Second, the absence of phone support could be inconvenient for some clients who prefer direct verbal communication.

Lastly, the variation in regulatory oversight across entities means traders must carefully select the entity under which they open their accounts. Some entities offer robust regulatory protections, while others are registered offshore without the same level of oversight.

Our Verdict

While it’s not without its limitations, StarTrader’s blend of accessibility, advanced technology, and regulatory safeguards provides a solid foundation for anyone looking to explore the financial markets.

Whether you’re a beginner seeking an easy entry point or an experienced trader in search of fast execution and low-latency options, StarTrader’s comprehensive service suite ensures that most trading styles and preferences are accommodated.