| 🏛️ Based in | Limassol, Cyprus |

|---|---|

| ⚖️ Regulation | FSCA |

| 💰 Minimum Deposit | $250 |

| 💳 Deposit Options | VISA, MasterCard, Bank Wire, Neteller, Skrill. |

| 💳 Withdrawal Options | VISA, MasterCard, Bank Wire, Neteller, Skrill. |

| 📌Open an account | Start Trading with TrioMarkets |

Contents

- 1 Our Opinion about TrioMarkets

- 2 Key Benefits

- 3 TrioMarkets Regulation

- 4 TrioMarkets: Legit or Scam?

- 5 TrioMarkets Instruments

- 6 Account Types

- 7 Islamic Swap-Free Accounts

- 8 Trading Tools

- 9 Leverage, Spreads and Commissions

- 10 TrioMarkets Registration – How To Open A Trading Account

- 11 Registration – How To Verify A Trading Account

- 12 Deposits & Withdrawals

- 13 Trading Platforms

- 14 Trading Tools

- 15 Bonus and Promotions

- 16 Education

- 17 TrioMarkets Customer Support

- 18 Our Opinion

- 19 Forex Broker Review FAQs

- 20 Similar Brokers

Our Opinion about TrioMarkets

TrioMarkets is a reputable forex and CFD broker that has been serving traders globally since 2014. Based in Cyprus, this broker is well-regulated and offers competitive trading conditions on the popular MetaTrader 4 platform. Kenyan traders considering TrioMarkets will appreciate its wide range of tradable instruments, multiple account types to suit different trading styles and budgets, helpful trading tools, and quality educational resources.

While TrioMarkets has higher minimum deposits than some brokers, its tight spreads, reliable trade execution, and strong regulatory oversight help make it an appealing choice for many traders in Kenya looking for a trusted broker partner. The broker’s excellent customer support and transparency further enhance its reputation.

Key Benefits

TrioMarkets Regulation

TrioMarkets is a licensed forex broker that operates under the regulatory supervision of many different regulatory authorities. TrioMarkets is a trade name used by several different companies, all run by the same management, and all working together as one group. Together, the TrioMarkets companies have licences and registration with the following regulatory authorities.

One of the broker’s’ key strengths is its solid regulatory framework. The broker’s parent company, Benor Capital Ltd, is authorized and regulated by the Financial Services Commission (FSC) of Mauritius under license number C118023678.

An additional layer of regulatory oversight is provided by the broker’s other operating entity, EDR Financial Ltd, which is registered as a Cyprus Investment Firm (CIF) with license number 268/15 from the Cyprus Securities and Exchange Commission (CySEC). As a CySEC-regulated broker, TrioMarkets must comply with strict European regulatory requirements like client fund segregation and participation in investor compensation schemes.

TrioMarkets: Legit or Scam?

Based on our TrioMarkets wide analysis and positive overall reputation, we consider TrioMarkets to be a legitimate broker, not a scam. The company is transparent about its ownership, regulatory status, and trading conditions. It keeps client funds segregated and offers negative balance protection to retail clients.

It is important to remember that trading forex and CFDs is risky, and even with a legit broker, you can lose money if markets move against you. But in terms of broker reliability and security, Kenyan traders can feel confident that the broker is properly regulated and committed to fair, responsible practices. The broker has generally positive reviews from clients and has not been involved in major regulatory scandals.

TrioMarkets Instruments

TrioMarkets provides access to trade a good selection of instruments, with a focus on forex currency pairs. Highlights of the broker’s 140+ tradable products include:

- 60+ forex pairs across majors, minors and exotics

- Spot metals like gold and silver

- Energy CFDs including oil and gas

- Stock index CFDs on major global indices

- Popular share CFDs

- Cryptocurrency CFDs including Bitcoin

This wide asset choice allows Kenyan traders to diversify across markets and implement various strategies. The broker’s spreads are quite competitive, especially for forex trading, helping keep costs down.

Account Types

TrioMarkets has several different account types and each comes with its own unique trading conditions. Here’s what you can expect from each account.

| Type | Spreads | Min. Deposit | Max. Leverage | Commission |

|---|---|---|---|---|

| Basic | From 2.4 pips | $100 | 1:500 | $0 |

| Standard | From 1.4 pips | $5,000 | 1:500 | $0 |

| Premium | From 1.1 pips | $25,000 | 1:500 | $0 |

| VIP | From 0.0 pips | $50,000 | 1:500 | $4 per lot |

Islamic Swap-Free Accounts

All of the TrioMarkets accounts are also available as Islamic Swap-Free trading accounts, and you can choose this option when opening your online trading account.

Trading Tools

TrioMarkets provides clients with some helpful trading tools to enhance their market analysis and trading performance. These include:

- Advanced charting tools in MetaTrader 4

- Free VPS service for qualifying accounts

- Trading signals from in-house analysts

- Economic calendar to track key events

- Regular market analysis and insights

These tools are designed to give Kenyan traders an edge and help inform smarter trading decisions. TrioMarkets clients can access these valuable resources right from their trading account.

Leverage, Spreads and Commissions

TrioMarkets allows leverage as high as 1:500 depending on the instrument traded. For forex, the maximum leverage is usually 1:500. This gives traders the ability to open larger positions with less capital, but also increases risk.

TrioMarkets offers very competitive spreads, especially on its Premium and VIP accounts. Spreads can be as low as 0.0 pips on major forex pairs like EUR/USD with the broker’s raw pricing. For commission-free accounts, minimum spreads range from 1.1 to 2.4 pips based on account type.

On the VIP account with raw spreads, the broker charges a reasonable commission of $4 per round turn standard lot, or $8 per lot total. There are no hidden fees, and the broker is transparent about its pricing.

TrioMarkets Registration – How To Open A Trading Account

As part of our broker review, we checked their online registration process and how easy it is to open a trading account. If you live in Kenya, then you can trade with TrioMarkets.

- Visit the TrioMarkets website and click “Register”

- Fill in the online registration form with your details

- Verify your email address

- Provide the required identity and residency documentation

- Wait for your account to be approved and make your first deposit

Once your live account is active and funded, you can download MetaTrader 4, login with your credentials, and start trading. Demo accounts are also available if you wish to practice risk-free first.

Registration – How To Verify A Trading Account

As part of our TrioMarkets broker review, we also looked at their verification process and how easy it to finish setting up the account. To verify the account, you’ll need to show TrioMarkets a proof of ID and a proof of address. This is so that they can they can complete their regulatory checks. You can provide copies of your National ID card, Passport or Driving License. You can also provide copies of a utility bill or a bank statement registered in your name.

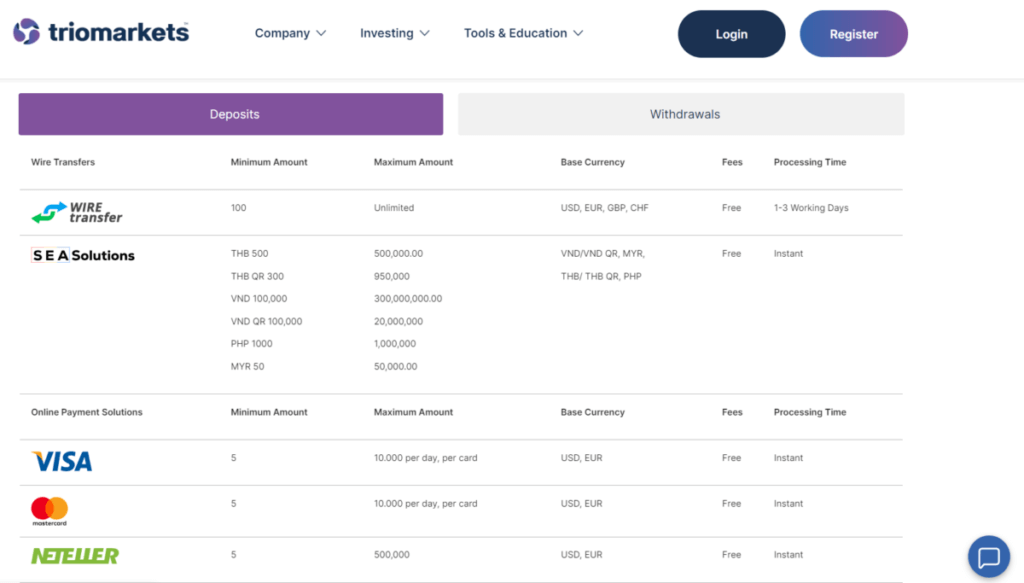

Deposits & Withdrawals

TrioMarkets has many funding methods. You can fund your account using a debit card, credit card, or bank transfer. You can also use other deposit methods such as Neteller account or Skrill account. You can also withdraw money from your account using any of the same withdrawal methods.

Trading Platforms

TrioMarkets provides the popular MetaTrader 4 (MT4) platform for trading on desktop, web, and mobile devices. Key features of MT4 include:

- Intuitive, customizable interface

- Advanced charting tools with extensive indicators and drawing tools

- Ultra-fast order execution with one-click trading

- Automated trading compatible with expert advisors (EAs)

- Secure, encrypted communication between trader and broker

The MT4 platform is an industry standard, packed with tools to help you analyze markets, place trades, and manage your account. You can even trade on the go with MT4’s full-featured mobile apps for iOS and Android. This broker also offers support for additional tools that expand the default MT4 capabilities.

Trading Tools

TrioMarkets provides clients with some helpful trading tools to enhance their market analysis and trading performance. These include:

- Advanced charting tools in MetaTrader 4

- Free VPS service for qualifying accounts

- Trading signals from in-house analysts

- Economic calendar to track key events

- Regular market analysis and insights

These tools are designed to give Kenyan traders an edge and help inform smarter trading decisions. TrioMarkets clients can access these valuable resources right from their trading account.

Bonus and Promotions

TrioMarkets offers occasional bonuses and promotional offers to its clients. Specifics vary over time, but some examples include:

- Welcome Bonus

- Loyalty Program

- Refer-a-Friend

It’s important to carefully review terms and conditions of any bonus offer before accepting it, as there are usually requirements that must be met to realize the full benefit.

Education

TrioMarkets has a good selection of educational materials. It gives you access to educational videos, eBooks, trading glossaries, and many other tools.

TrioMarkets Customer Support

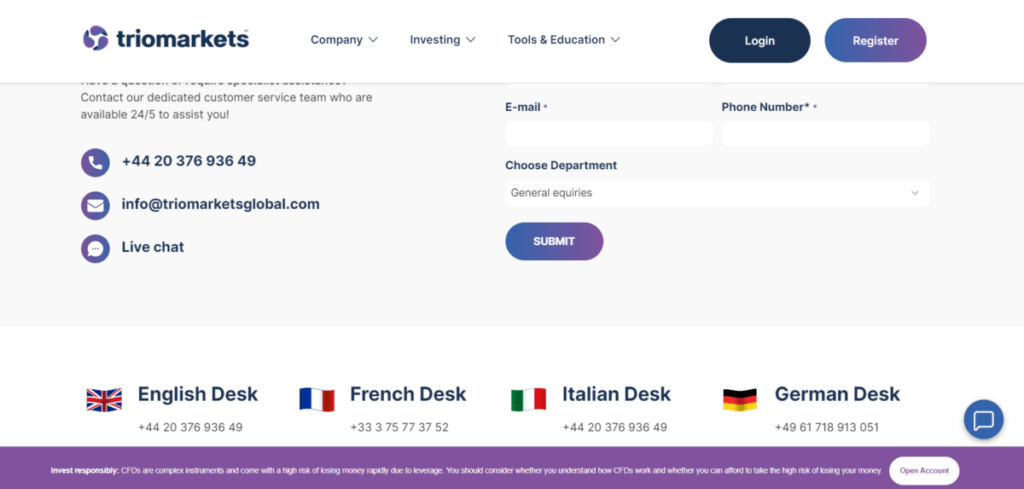

This broker offers excellent customer service. You can contact their Customer Support via;

- Phone

- Live chat

- You can also contact them online via their contact us form.

Our Opinion

After thoroughly reviewing TrioMarkets, we believe this broker is a solid choice for Kenyan traders. It offers strong regulation, competitive trading conditions, a wide range of instruments, and the popular MT4 platform. The broker provides quality educational resources and reliable customer support. While minimum deposits are higher than some brokers, TrioMarkets’ overall package of features and benefits makes it a compelling choice. For Kenyan traders seeking a reputable, long-established broker, it is well worth considering.

Forex Broker Review FAQs

TrioMarkets is not directly regulated by Kenyan authorities. However, the broker is in collaboration in major jurisdictions like Cyprus (CySEC) and Mauritius (FSC).

TrioMarkets keeps client funds in segregated accounts at top tier banks, ensuring your deposits are not mixed with the broker’s own capital.

No, TrioMarkets accounts are denominated in USD, EUR, GBP and CHF. Kenyan traders must convert their Shillings into one of these base currencies to fund their account.

Ready to start trading? Sign up for an online trading account with TrioMarkets here.

Similar Brokers

Broker | |||||

Review | |||||

CopyTrading | |||||

Platforms |