As a trader, knowledge is power, and access to reliable market analysis can be the key to unlocking profitable opportunities. As more and more traders enter the forex market, the demand for comprehensive and timely market insights has never been greater. Recognizing this need, many leading forex brokers have risen to the challenge, offering a wealth of free market analysis tools and resources designed to empower traders at all levels. From real-time data and advanced charting tools to expert commentary and educational materials, these brokers provide the essential support that traders need when trading.

If you’re looking for forex brokers with free market analysis, here are some of the best ones:

Broker | Features | Broker Review | Visit |

* 1:400 leverage * 1000+ instruments * $0 min. deposit * CMA licence | |||

* 1:1000 leverage * 1200+ instruments * $5 min. deposit * CMA licence | |||

* 1:888 leverage * 1000+ instruments * $5 min. deposit * CySEC licence | |||

* 1:400 leverage * CMA licence | |||

* 1:500 leverage * 10,000 instruments * $100 min. deposit * ASIC licence | |||

* 1:500 leverage * 80+ instruments * $200 min. deposit * ASIC licence | |||

* 1:1000 leverage * 200+ instruments * $1 min. deposit * CySEC licence | |||

* 1:2000 leverage * 250+ instruments * $50 min. deposit * CMA licence |

Contents

- 1 The Importance of Market Analysis in Forex Trading

- 2 Fundamental Analysis: Understanding Economic and Political Influences

- 3 Technical Analysis: Identifying Trends and Patterns

- 4 Top Forex Brokers with Free Market Analysis

- 5 1. Pepperstone

- 6 2. HFM

- 7 3. XM

- 8 4. FP Markets

- 9 Maximizing the Benefits of Free Market Analysis

- 10 Final Thoughts

The Importance of Market Analysis in Forex Trading

Market analysis plays a role in successful forex trading, enabling traders to make informed decisions based on a thorough understanding of market dynamics. By analyzing economic, political, and social factors and studying historical price data and chart patterns, traders can identify potential trading opportunities and develop effective trading strategies.

Free market analysis provided by forex brokers can be an invaluable resource for traders. It offers expert insights, powerful tools, and timely information to help them stay ahead of the curve. By leveraging these resources, traders can better understand market trends, identify key support and resistance levels, and make more accurate predictions about future price movements.

Fundamental Analysis: Understanding Economic and Political Influences

Fundamental analysis is a critical component of market analysis, focusing on the underlying economic and political factors that can impact currency prices. By studying economic indicators such as GDP, inflation rates, interest rates, and employment figures, traders can assess the strength of a country’s economy and anticipate potential currency fluctuations.

Forex brokers that offer free market analysis often provide economic calendars, news updates, and expert commentary to help traders stay informed about key fundamental events. By monitoring these factors, traders can make more informed decisions about when to enter or exit trades and adjust their strategies accordingly.

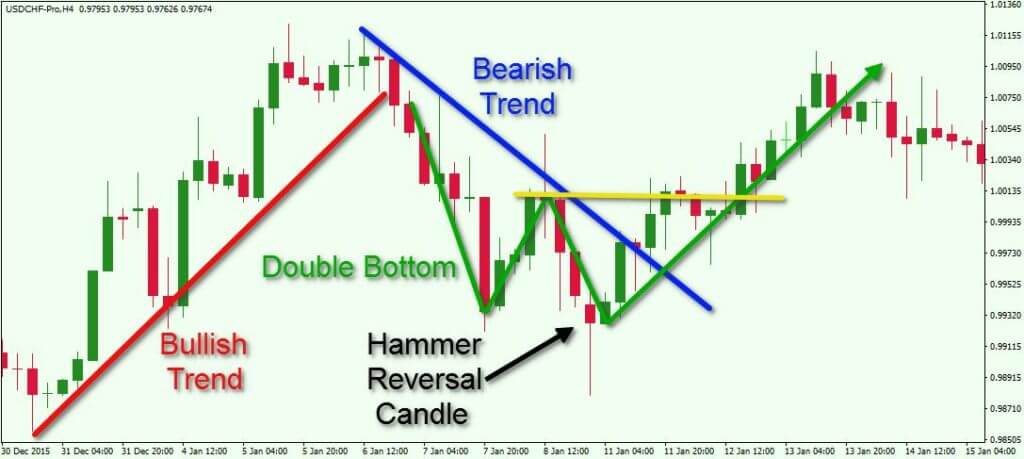

Technical Analysis: Identifying Trends and Patterns

Technical analysis is another crucial aspect of market analysis. It involves studying historical price data and chart patterns to predict future price movements. By using charting tools and indicators such as moving averages, relative strength index (RSI), and Fibonacci retracements, traders can identify trends, support and resistance levels, and potential entry and exit points.

Many forex brokers provide advanced charting platforms and technical analysis tools as part of their free-market analysis offerings. These tools allow traders to customize their charts, apply various indicators, and perform in-depth analysis to identify potential trading opportunities.

Top Forex Brokers with Free Market Analysis

1. Pepperstone

- 1:400 leverage

- 1000+ instruments

- $0 minimum deposit

- CMA license

- Advanced charting tools and technical analysis indicators

- Daily market analysis and insights from expert analysts

- Regular webinars and educational resources to help traders improve their skills

Pepperstone is a highly regarded forex broker that offers a comprehensive suite of free market analysis tools and resources. With advanced charting capabilities, daily market insights from experienced analysts, and a wide range of educational materials, Pepperstone empowers traders to make informed decisions and refine their trading strategies.

2. HFM

- 1:1000 leverage

- 1200+ instruments

- $5 minimum deposit

- CMA license

- Comprehensive market research and analysis

- Regular webinars and educational resources

- Powerful trading platform with advanced charting tools

HFM is another top choice for traders seeking free market analysis, offering a wealth of research and educational resources to support their trading activities. With daily market analysis, regular webinars, and a user-friendly trading platform, HFM provides traders with the tools and insights they need to succeed in the forex market.

3. XM

- 1:888 leverage

- 1000+ instruments

- $5 minimum deposit

- CySEC license

- Daily market analysis and trading signals

- Advanced trading platform with technical analysis tools

- Comprehensive educational resources, including webinars and tutorials

XM is a well-established forex broker that offers a range of free market analysis tools and resources to its clients. With daily market analysis, trading signals, and an advanced trading platform, XM provides traders with the support they need to make informed trading decisions. The broker also offers a wide range of educational materials, including webinars and tutorials, to help traders improve their skills and knowledge.

4. FP Markets

- 1:500 leverage

- 10,000 instruments

- $100 minimum deposit

- ASIC license

- Daily market reports and analysis

- Powerful charting tools and technical indicators

- Regular webinars and educational resources

FP Markets is a reputable forex broker that offers its clients comprehensive free market analysis. With daily market reports, advanced charting tools, and a wide range of technical indicators, FP Markets offers traders the resources they need to analyze market trends and identify potential trading opportunities. The broker also provides regular webinars and educational materials to help traders enhance their skills and stay up-to-date with the latest market developments.

Maximizing the Benefits of Free Market Analysis

To get the most out of the free-market analysis provided by forex brokers, consider the following tips:

- Stay up-to-date with economic calendars and news events: Track key economic releases and political developments that can impact currency prices and adjust your trading strategies accordingly.

- Combine fundamental and technical analysis for a comprehensive approach: Use both fundamental and technical analysis to gain a holistic understanding of market dynamics and identify potential trading opportunities.

- Utilize advanced charting tools and indicators to identify trends and patterns: Forex brokers provide powerful charting tools and technical indicators for analyzing historical price data and identifying trends and patterns.

- Attend webinars and educational sessions offered by brokers to enhance your knowledge: Participate in webinars and educational sessions provided by forex brokers to stay informed about the latest market developments and improve your trading skills.

- Incorporate market analysis into your trading plan and risk management strategy. Use the insights gained to develop a comprehensive strategy. This will help you trade with discipline and minimize potential losses.

Final Thoughts

Free market analysis offered by forex brokers is an invaluable resource for traders looking to make informed trading decisions in the dynamic forex market. By choosing a reputable broker that provides comprehensive market analysis tools, expert insights, and educational resources, traders can gain a competitive edge and improve their chances of success.

To maximize the benefits of free market analysis, staying informed about economic events, combining fundamental and technical analysis, and using advanced charting tools are essential.