| Feature | Details |

| ✅ Regulations | FSCA (South Africa), CIMA (Cayman Islands), ASIC (Australia), VFSC (Vanuatu) |

| 🌐 Supported Languages | English, French, Arabic, Italian, Spanish, Chinese, Greek, Malaysian |

| 💰 Products | Currencies, Stocks, ETFs, Crypto, Indices, Commodities, Futures |

| 💵 Min Deposit | $50 |

| 📈 Max Leverage | 1:500 (FSCA), 1:250 (CIMA), 1:30 (ASIC), 1:500 (VFSC) |

| 🖥️ Trading Desk Type | ECN |

Contents

- 1 Our Opinion About Vantage Markets

- 2 Regulation and Kenyan Traders

- 3 Is Vantage Markets Legit for Kenyan Traders?

- 4 Trading Instruments

- 5 Account Types

- 6 Standard STP Account

- 7 Raw ECN Account

- 8 Pro ECN Account

- 9 Trading Tools

- 10 Leverage and Commissions

- 11 Vantage Markets Deposits and Withdrawals

- 12 Vantage Deposit Methods

- 13 Vantage Withdrawal Methods

- 14 Vantage Markets Registration – How to Open a Trading Account

- 15 Vantage Markets Bonuses and Promotions

- 16 Trading Platforms

- 17 Education and Research

- 18 Customer Support

- 19 Our Verdict

- 20 FAQs

Our Opinion About Vantage Markets

Vantage Markets, formerly known as Vantage FX, has been a prominent player in the forex industry since 2009. Over the years, the forex broker has established itself as a competitive option for Kenyan traders looking to participate in the global financial markets. With its strong regulatory background, a diverse range of trading instruments, and advanced trading platforms, this forex broker offers forex enthusiasts a robust trading experience.

What sets Vantage Markets apart for traders is its combination of accessibility and sophistication. The low minimum deposit of $50 makes it an attractive option for beginners in the Kenyan market who are just starting their forex journey. At the same time, the broker’s advanced ECN accounts and professional-grade tools cater to more experienced traders who demand institutional-level trading conditions.

For Kenyan traders specifically, Vantage Markets provides an opportunity to access global markets with a broker that understands the unique needs of emerging market traders. The availability of various account types allows Kenyan traders to choose a setup that best suits their trading style and capital availability. Read on to learn more from our Vantage Markets broker review.

Regulation and Kenyan Traders

While Vantage Markets isn’t specifically regulated in Kenya, it operates under the oversight of several respected global financial authorities. This multi-jurisdictional regulatory framework, including ASIC and FCA, provides Kenyan traders with a significant level of security and credibility. However, Kenyan traders should be aware that the level of protection may vary depending on which Vantage entity they are dealing with.

Is Vantage Markets Legit for Kenyan Traders?

Vantage Markets has established itself as a legitimate forex broker, which is crucial for Kenyan traders looking for a reliable platform. The company’s adherence to strict financial standards, transparent operations, and clear communication about trading conditions instils confidence in its legitimacy. While no broker is without risk, our Vantage Markets broker review shows that Vantage Markets is a trustworthy option for Kenyan forex traders.

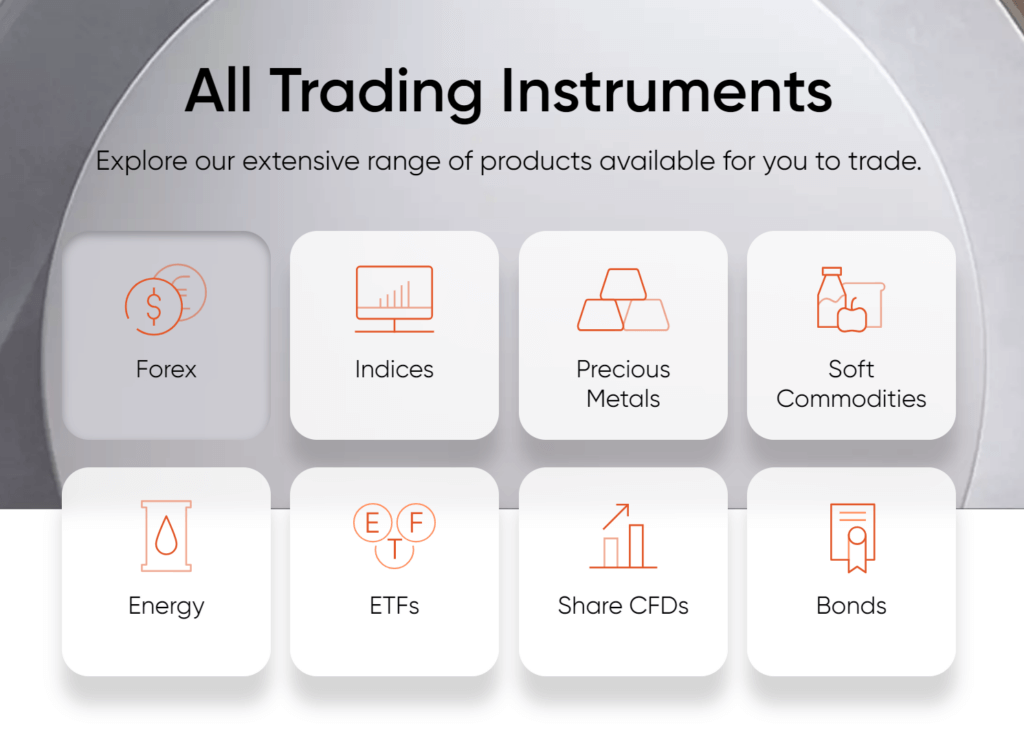

Trading Instruments

Vantage Markets offers a wide range of trading instruments that can appeal to Kenyan traders:

This diverse selection allows Kenyan traders to explore various markets and potentially hedge against local currency fluctuations.

Account Types

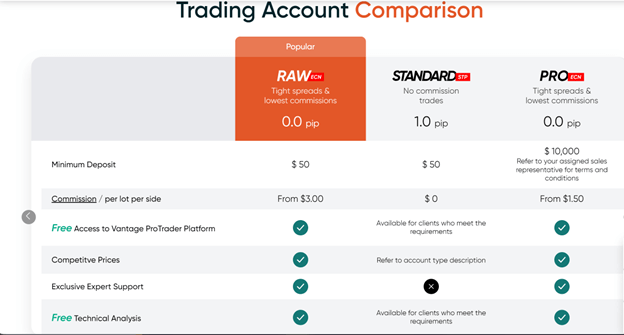

Vantage Markets offers three main account types to cater to different trading styles and experience levels:

All account types provide access to Vantage Markets’ full range of trading instruments and platforms, allowing Kenyan traders to choose based on their experience and trading volume.

Standard STP Account

Ideal for beginners and traders who prefer simplicity, this account features:

- Low $50 minimum deposit

- Spread-based pricing without additional commissions

- Straightforward structure for learning the basics of trading

Raw ECN Account

Suited for more experienced traders, this account offers:

- Low $50 minimum deposit

- Direct interbank market access

- Tighter spreads with a commission-based model

- Potential for faster execution and reduced slippage

Pro ECN Account

Designed for professional and high-volume traders, this account provides:

- $10,000 minimum deposit

- Tightest spreads and lowest commissions

- Institutional-grade trading conditions

All account types grant traders access to Vantage Markets’ full range of trading instruments and platforms, allowing them to explore various markets and utilise advanced tools, regardless of their chosen account level.

Trading Tools

Vantage Markets provides several tools that can be particularly useful for Kenyan traders:

- Economic Calendar: Helps track important global events that may impact the Kenyan Shilling

- Trading Central: Offers technical analysis and trading signals for various instruments

- Autochartist: Provides automated chart pattern recognition, useful for busy Kenyan traders

- VPS Hosting: Beneficial for Kenyan traders using automated strategies, ensuring consistent execution despite potential local internet issues

Leverage and Commissions

This forex broker offers competitive trading conditions that Kenyan traders should consider carefully:

- Leverage: Up to 1:500, which can be attractive but also risky for Kenyan traders

- Spreads: As low as 0.0 pips on ECN accounts

- Commissions: $3 per lot on Raw ECN, $2 per lot on Pro ECN

Kenyan traders should be aware of the risks associated with high leverage and ensure they understand the fee structure before trading.

Vantage Markets Deposits and Withdrawals

Vantage Deposit Methods

| Payment Method | Currency | Fee | Processing Time |

| Bank Wire | AUD, USD, GBP, EUR, SGD, JPY, NZD, CAD, PLN | $0 | 2-5 business days |

| Credit/Debit Card | AUD, USD, GBP, EUR, SGD, JPY, NZD, CAD, PLN | $0 | Instant |

| E-wallets (Skrill, Neteller) | Varies | Subject to e-wallet fees | Instant to 24 hours |

| Cryptocurrency | Not Specified | $0 | 1 hour |

| Local Payment Methods | Varies | $0 | Instant |

Vantage Withdrawal Methods

| Payment Method | Fee | Processing Time |

| Bank Wire | $0 | 3-5 business days |

| Credit/Debit Card | $0 | 2-3 business days |

| E-wallets | $0 | Varied |

| Crypto Wallets | $0 | Varied |

Vantage Markets offers a diverse range of deposit and withdrawal options, accommodating traders from various regions and with different preferences. The broker maintains a no-fee policy for most transactions, enhancing cost-effectiveness for its clients. While traders should be aware of potential third-party fees, especially for international transfers, Vantage demonstrates its commitment to customer satisfaction by covering the 20-unit fee for the first international bank transfer withdrawal each month. This flexible approach to payments reflects the forex brokers’ dedication to providing convenient and cost-effective services to its global client base.

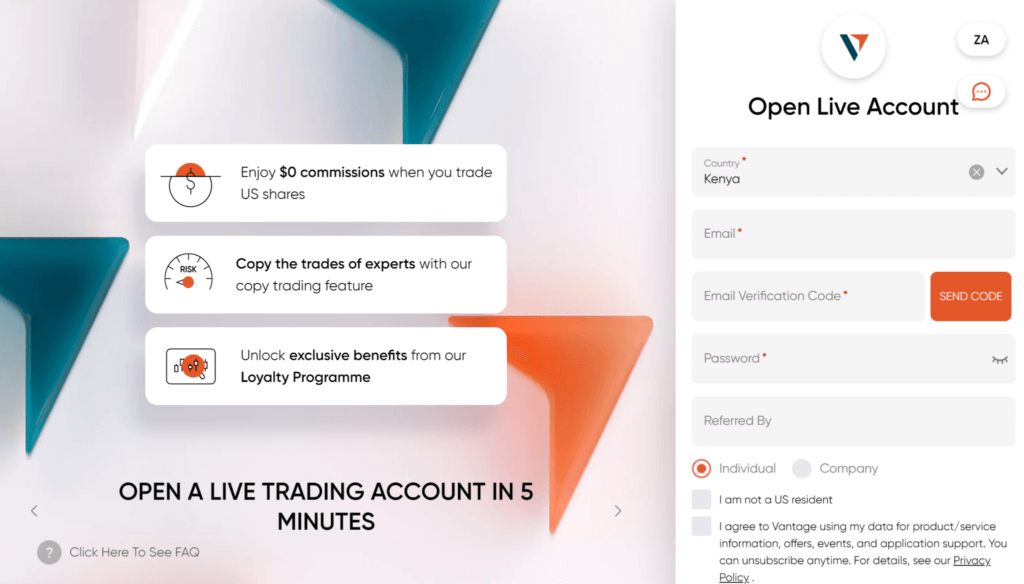

Vantage Markets Registration – How to Open a Trading Account

Opening an account with this forex broker is a straightforward process:

- Visit the Vantage Markets website and click “Open Live Account”

- Fill in your personal details and select your account type

- Upload verification documents (ID and proof of address)

- Fund your account

- Start trading

The entire process usually takes less than 24 hours, assuming all required documents are provided promptly.

Vantage Markets Bonuses and Promotions

Vantage Markets offers an impressive array of bonuses and promotions designed to attract new traders and reward loyal customers. These incentives range from competitive to potentially lucrative:

- Trading Championship 2024: An opportunity for traders to compete globally and win up to $100,000.

- Deposit Bonus: New traders can kickstart their journey with bonuses on their first and subsequent deposits.

- Vantage Rewards: A loyalty program where traders earn V-Points through trading activities, redeemable for various rewards.

- Refer A Friend: Earn up to $100 for yourself and $50 for your friend when you make a successful referral.

- 13% p.a. Funds Growth: An innovative offer providing up to 13% annual interest on deposits for traders in South Africa and beyond, enhancing the growth potential of idle funds.

- Demo Contest: Participate in risk-free trading contests with the chance to win up to $2,000.

- Trading Tools: Access to premium tools like Free VPS, TradingView, Trading Signals, and ProTrader Tools upon meeting specific criteria.

While these promotions are enticing, it’s crucial for traders to carefully review the terms and conditions associated with each offer. Availability may vary by jurisdiction, and certain requirements must be met to qualify for and maintain these bonuses.

Trading Platforms

Vantage Markets offers several trading platforms that Kenyan traders can access:

These platforms are available on desktop, web, and mobile devices, providing flexibility for Kenyan traders to access their accounts from anywhere in the country.

Education and Research

This forex broker provides educational resources that can benefit Kenyan traders:

- Webinars and Seminars

- Trading Guides

- Video Tutorials

- Trading eBooks

In terms of research, our Vantage Markets broker review shows that Kenyan traders can access:

- Daily Market Analysis

- Economic Calendar

- Trading Central Insights

These tools can help Kenyan traders stay informed about global market trends and make data-driven trading decisions.

Customer Support

Vantage Markets provides customer support through multiple channels, which Kenyan traders can access:

- 24/5 Live Chat

- Email Support

- Phone Support

- FAQ Section

While the support team is generally responsive, Kenyan traders should be aware of potential time zone differences when seeking assistance.

Our Verdict

According to our Vantage Markets broker review, Vantage Markets is a solid option for Kenyan forex traders. Its strong regulatory background, competitive trading conditions, and diverse range of instruments are notable strengths. The low minimum deposit of $50 makes it accessible to many Kenyan traders, while the ECN account options cater to more experienced traders in the country.

However, Kenyan traders should conduct their research, consider their individual trading goals and risk tolerance, and be aware of the legal and tax implications of forex trading in Kenya before opening an account with Vantage Markets.

FAQs

Yes, Vantage Markets accepts traders from Kenya.

Yes, Kenyan traders can use the Vantage App for mobile trading on iOS and Android devices.

While Vantage Markets offers various promotions, Kenyan traders should check the current offers and their eligibility, as these may vary by region.

Kenyan traders can reach Vantage Markets support via 24/5 live chat, email, or phone.