Copy trading has become an increasingly popular tool in the forex market. It automatically allows traders to replicate the trades of more experienced traders or the best brokers with copytrading. This guide will explain how copy trading works, its benefits and risks, and strategies for maximizing your success with this powerful trading approach.

Here is a list of our best brokers with copytrading tools.

Broker | Features | Broker Reviews | Visit |

* CMA regulated * 1:1000 leverage * $50 min. deposit | |||

* CMA regulated * 1:500 leverage * $200 min. deposit | |||

* 1:1000 leverage * 950+ instruments * Copy trading | |||

* 1:1000 leverage * $15 min. deposit | |||

* 1:500 leverage * $200 min. deposit | |||

* 1:500 leverage | |||

* 1:500 leverage | |||

*1:500 leverage | |||

* 1:500 leverage * STP broker * $100 min. deposit * Great support | |||

* Cryptotrading * Great education | |||

* 1:500 leverage * 300+ instruments * $50 min. deposit * Great trading tools | |||

* 1:777 leverage * $100 min. deposit | |||

* 1:1000 leverage * $5 min. deposit | |||

* 1:500 leverage * 800+ instruments * $10 min. deposit * African broker | |||

* 1:1000 leverage * $1 min. deposit |

Contents

- 1 What is Copy Trading?

- 2 How Does Copy Trading Work?

- 3 Mirror Trading vs Copy Trading

- 4 Social Trading vs Copy Trading

- 5 Is Copy Trading Profitable?

- 6 Pros and Cons

- 7 Strategies for Successful Copy Trading

- 8 1. Do your due diligence

- 9 2. Start small

- 10 3. Diversify across multiple providers

- 11 4. Set risk management parameters

- 12 5. Continue to learn and grow

- 13 Is Copy Trading Right for You?

- 14 Our Thoughts on This

What is Copy Trading?

Copy trading is a trading method that allows you to automatically copy the trades of other traders in real time. When you use copy trading, you link a portion of your trading account to another trader’s account. Whenever that trader, known as the “signal provider,” opens or closes a trade, the copy trading platform automatically executes the same trade in your linked account in proportion to the amount of money you’ve allocated.

Copy trading originated in the forex market but has since expanded to other markets, such as stocks, commodities, and cryptocurrencies. Some of the best brokers with copytrading and trading platforms now offer copy-trading features.

How Does Copy Trading Work?

Here’s a step-by-step breakdown of how copy trading typically works:

1. You open an account with a broker that offers copy trading.

2. You browse through the broker’s network of signal providers. These are the traders whose trades you can choose to copy.

3. You select one or more signal providers based on criteria like their historical performance, risk profile, trading style, and the instruments they trade.

4. Next, you must allocate a portion of your trading account to be linked to each selected signal provider.

5. Whenever a signal provider opens a trade, that trade is automatically replicated in your account in proportion to the amount you’ve allocated.

6. When the signal provider closes their trade, your copy of that trade is also closed.

Many copy trading platforms allow you to set risk management parameters, such as maximum loss amounts or the maximum number of trades to copy. Some also allow you to approve trades before they’re copied manually.

Mirror Trading vs Copy Trading

These two terms are often used interchangeably, but some differences exist. Mirror trading involves copying the trades of a successful trader or a group of traders. The trades are usually based on algorithms or pre-determined trading strategies.

On the other hand, copy trading involves copying individual traders’ trades in real time. The signal provider has full control over their trading decisions, and the copier can choose to copy all or some of the provider’s trades.

Social Trading vs Copy Trading

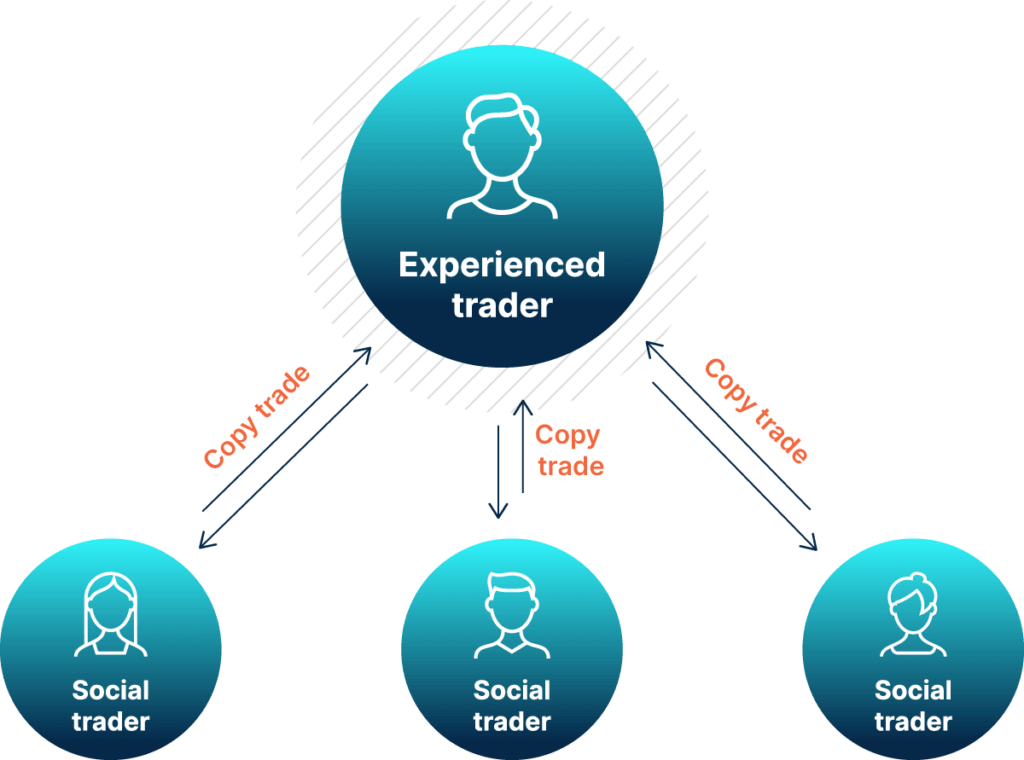

Social trading is a broader concept that encompasses copy trading. It refers to the idea of using social media-like platforms to share trading ideas, strategies, and signals with other traders. Traders can interact with each other, discuss market trends, and make informed trading decisions based on the community’s collective knowledge.

Copy trading is a specific type of social trading where traders can directly copy the trades of others. While social trading platforms often include copy-trading features, not all social trading involves copy-trading.

Is Copy Trading Profitable?

Copy trading can be profitable, but it’s not a guaranteed way to make money. The profitability of copy trading largely depends on the skill and performance of the signal providers you choose to follow.

Some key factors that can impact the profitability of copy trading include:

- The fees and commissions charged by the broker or platform

- The trading style and risk management of the signal provider

- Market conditions and volatility

- The amount of capital you allocate to each signal provider

It’s important to remember that past performance does not guarantee future results. Even the most successful traders can have losing streaks.

Pros and Cons

| Benefits of Copy Trading | Risks of Copy Trading |

| Past performance doesn’t guarantee future results Just because a signal provider has a good track record in the past doesn’t mean it will continue to be successful in the future. Market conditions change, and past strategies may not always remain effective. | Signal providers can have losing trades No trader is right 100% of the time. Even skilled signal providers can have losing trades. If you’re copying their trades, you’ll also experience those losses. |

| Diversify your trading portfolio You can diversify your trading portfolio by copying multiple signal providers who trade different instruments or use different strategies. This can help manage risk. | Past performance doesn’t guarantee future results Just because a signal provider has had a good track record in the past doesn’t mean they’ll continue to be successful in the future. Market conditions change, and past strategies may not always remain effective. |

| Lack of understanding If you’re simply copying trades without understanding the underlying strategies, you may not be prepared to manage the trades independently if you decide to stop copy trading. | Lack of understanding If you’re simply copying trades without understanding the underlying strategies, you may not be prepared to manage the trades on your own if you decide to stop copy trading. |

| Emotional detachment Emotional factors like fear or greed can negatively impact trading decisions. Copy trading can help remove these emotional influences since trades are executed automatically based on the signal provider’s actions. | Over-reliance on signal providers Relying too heavily on signal providers can lead to a lack of personal growth and development as a trader. |

Strategies for Successful Copy Trading

To maximize your chances of success with copy trading, consider these strategies

1. Do your due diligence

Thoroughly research some of the best brokers with copytrading before committing to copying their trades. Look at factors beyond their profitability, such as risk management practices, trading frequency, and communication with followers.

2. Start small

When you first start copy trading with a new signal provider, allocate a smaller portion of your capital. This allows you to test the provider’s performance with less risk.

3. Diversify across multiple providers

Don’t put all your eggs in one basket. Spread your copy trading capital across multiple signal providers to diversify your risk.

4. Set risk management parameters

Use the risk management features your copy trading platform offers, such as stop-losses or maximum drawdown limits. This can help limit your potential losses.

5. Continue to learn and grow

Use copy trading as a learning opportunity. Analyze the trades of your signal providers to understand their strategies. Continue to educate yourself about the markets and trading in general.

Is Copy Trading Right for You?

Whether copy trading is a good fit depends on your circumstances, goals, risk tolerance, and choosing the best brokers with copytrading. It can be a useful tool for those looking to tap into more experienced traders’ skills or diversify their trading portfolio. However, it’s not a guaranteed path to profits and comes with risks.

Before engaging in copy trading, make sure you fully understand how it works and the potential downsides. Never invest more than you can afford to lose. And remember, copy trading should be just one part of a comprehensive trading plan, not a complete replacement for your own knowledge and analysis.

Our Thoughts on This

Copy trading can be a powerful tool in the forex market, offering the potential to benefit from the skills of experienced traders, save time, diversify your portfolio, and remove emotional influences from your trading. However, it’s important to understand the risks and to use copy trading wisely as part of a broader trading strategy. As with all forms of trading, success with copy trading requires diligence, continuous learning, and effective risk management. By understanding how copy trading works, carefully selecting the best brokers with copytrading, and employing smart strategies, you can potentially enhance your forex trading outcomes with this innovative trading method.