MetaQuotes’ MT5 (MetaTrader 5) is the latest evolution in online trading platforms. Designed to provide traders with a comprehensive and powerful toolset, MT5 has quickly become a favorite among forex, stocks, indices, commodities, metals, and cryptocurrency traders worldwide.

One of the critical advantages of MT5 is its versatility. Unlike its predecessor, MT4, which focused on forex trading, MT5 offers a broader range of asset classes and trading instruments. This allows traders to diversify their portfolios and explore new opportunities across various financial markets.

Here is a list of some of the most popular MT5 brokers in the forex industry.

Broker | Features | Review | Visit |

* CMA regulated * 1:1000 leverage * 1200+ instruments | |||

* CMA regulated * $200 min. deposit | |||

* CMA regulated * 1:400 leverage * $5 min, deposit | |||

* 1:1000 leverage * 950+ instruments * Copy trading | |||

* 1:1000 leverage * 210+ instruments * Free education | |||

* 1:500 leverage | |||

* 1:500 leverage | |||

* 1:500 leverage | |||

*1:500 leverage | |||

* 1:500 leverage * 390 instruments * Tight speads | |||

* 1:500 leverage * 300+ instruments * Low minimum deposit | |||

* 1:777 leverage | |||

* 1:1000 leverage | |||

* 1:500 leverage * 800+ instruments * African Broker | |||

* 1:1000 leverage | |||

* 1:1000 leverage |

Contents

- 1 Our Top 3 MT5 Forex Broker Recommendations

- 2 The Benefits of Trading with MT5

- 3 Advanced Analytical Tools

- 4 Extensive Charting Capabilities

- 5 Comprehensive Technical Indicators

- 6 Versatile Graphical Objects

- 7 Execution and Order Management

- 8 Order Types and Execution Modes

- 9 Advanced Order Management

- 10 Automated Trading and Expert Advisors

- 11 MQL5 Programming Language

- 12 Expert Advisor (EA) Integration

- 13 A Step-by-step Guide to Using the MetaTrader 5 Platform

- 14 Final Thoughts

Our Top 3 MT5 Forex Broker Recommendations

While all the brokers listed offer the MT5 platform, here are our top three recommendations:

- HFM: HFM is a well-established and regulated broker that provides access to the MT5 platform. Key features include a generous leverage of 1:1000, a wide range of over 1200 trading instruments, and comprehensive regulation from reputable authorities like the Cyprus Securities and Exchange Commission (CySEC).

2. Pepperstone: Pepperstone is another top-tier broker that offers MT5 along with over 1000 tradable instruments. Regulated by multiple tier-1 authorities, Pepperstone provides a seamless MT5 trading experience with a minimum deposit of just $200.

3. FXPesa: For traders looking for a low minimum deposit option, FXPesa is an attractive choice. With a minimum deposit of just $5, competitive leverage of 1:400, and regulation from CySEC, FXPesa offers a user-friendly MT5 experience suitable for both novice and experienced traders.

These brokers stand out for their robust MT5 offerings, regulatory compliance, competitive trading conditions, and user-friendly platforms. Ultimately, the choice of broker will depend on your specific trading needs and preferences.

The Benefits of Trading with MT5

Access to a wide range of financial instruments, including forex, stocks, indices, commodities, metals, and cryptocurrencies

- Advanced analytical tools for in-depth market research and strategy development

- Flexible charting capabilities with up to 100 charts and 21 different time frames

- Comprehensive suite of 38 built-in technical indicators and 39 graphical objects

- Robust order management features for precise trade execution and risk control.

- Support for automated trading and Expert Advisors (EAs) for algorithmic trading

Advanced Analytical Tools

The true strength of MT5 lies in its advanced analytical capabilities. The platform boasts an impressive array of features that empower traders to conduct thorough market research and develop sophisticated trading strategies.

Extensive Charting Capabilities

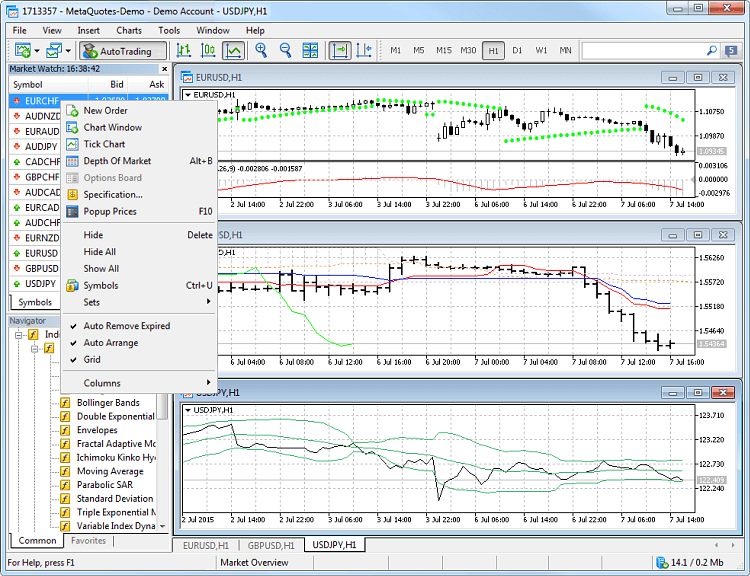

One of MT5’s standout features is its advanced charting system. Traders can open up to 100 charts simultaneously, each with access to 21 different time frames. This level of flexibility allows for in-depth technical analysis and the ability to monitor multiple markets and instruments simultaneously.

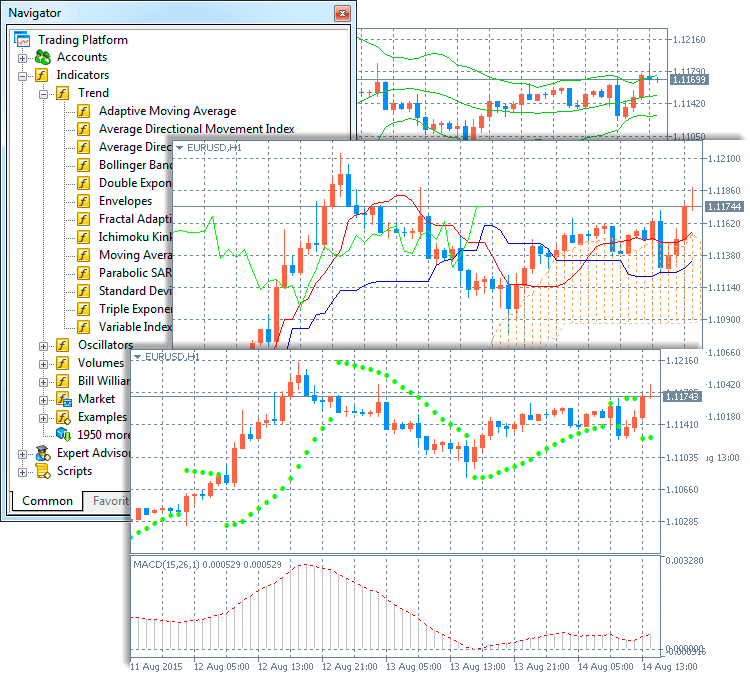

Comprehensive Technical Indicators

MT5 provides traders with a comprehensive suite of technical indicators, including 38 built-in indicators covering various technical analysis techniques. From classic moving averages and oscillators to more advanced indicators, traders can leverage this extensive toolset to identify trends, detect potential support and resistance levels, and make informed trading decisions.

Versatile Graphical Objects

The platform’s 39 graphical objects enable traders to annotate charts, draw trendlines, and create custom indicators and signals. This level of customization allows traders to tailor the platform to their specific trading styles and preferences, further enhancing their analytical capabilities.

Execution and Order Management

In addition to its analytical prowess, MT5 also excels in the realm of execution and order management. The platform offers a wide range of order types and execution modes, ensuring that traders have the flexibility to adapt their strategies to changing market conditions.

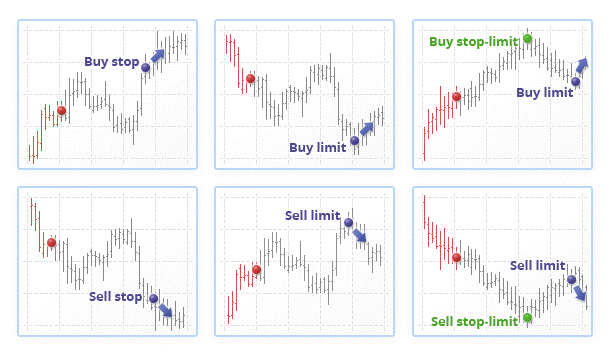

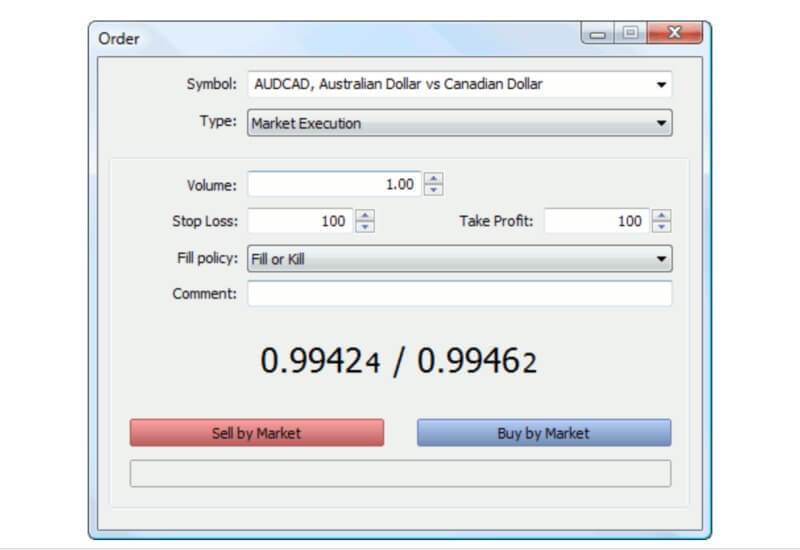

Order Types and Execution Modes

MT5 supports various order types, including market orders, limit orders, stop orders, and trailing stop orders. This allows traders to enter and exit positions precisely, minimizing the risk of unexpected market movements. Furthermore, the platform offers multiple execution modes, such as instant and market execution, catering to users’ preferences and trading styles.

Advanced Order Management

The platform’s order management features empower traders to monitor and control their open positions closely. Traders can set stop loss and take profit levels, modify existing orders, and even use trailing stops to adjust their positions as the market moves dynamically.

Automated Trading and Expert Advisors

One of MT5’s most powerful features is its support for automated trading and Expert Advisors (EAs). Traders can develop their custom algorithms and strategies using the platform’s built-in programming language, MQL5, and then deploy them to execute trades automatically.

MQL5 Programming Language

The MQL5 language, similar to C++, allows traders to create sophisticated trading robots, indicators, and other custom tools. This level of customization enables traders to automate their trading processes, backtest their strategies, and potentially gain an edge in the markets.

Expert Advisor (EA) Integration

MT5 seamlessly integrates with a wide range of Expert Advisors, which are prebuilt automated trading systems. Traders can choose from various EAs, each with unique trading strategies and risk management approaches, and then deploy them within the MT5 platform to execute trades autonomously.

A Step-by-step Guide to Using the MetaTrader 5 Platform

Navigating the MT5 platform may seem daunting initially, but traders can quickly become proficient with some practice. Here’s a step-by-step guide to help you get started:

- Download and Install MT5: Visit the MetaQuotes or your preferred broker’s website to download the MT5 platform. Then, follow the instructions to install the software on your computer or mobile device.

- Create a Trading Account: If you don’t already have one, open one with a broker offering the MT5 platform. You’ll be asked to provide personal information and make an initial deposit during the account opening process.

- Familiarize Yourself with the Platform: Once your account is set up, take some time to explore the MT5 platform. Familiarize yourself with the various menus, windows, and tools, such as the Market Watch, Navigator, and Terminal.

- Customize the Platform: MT5 allows you to personalize the platform to suit your trading preferences. You can adjust the layout, add or remove windows, and customize the appearance of the charts and indicators.

- Conduct Market Research: Use MT5’s advanced charting capabilities and technical indicators to analyze market trends, identify potential trading opportunities, and develop your trading strategies.

- Place Orders: When you’re ready to start trading, use the order entry window to place your trades. Experiment with different order types and execution modes to find the best approach for your trading style.

- Monitor and Manage Your Positions: Use the order management features in MT5 to closely monitor your open positions. Set stop loss and take profit levels, and use the trailing stop function to adjust your positions dynamically as the market moves.

- Explore Automated Trading: If you’re interested in algorithmic trading, you can create custom expert advisors using the MQL5 programming language. Alternatively, you can explore the various prebuilt EAs available and integrate them into your MT5 platform.

By following these steps, the Tradeforexke review team believes traders will be well on their way to mastering the MT5 platform and leveraging its powerful features to enhance their trading performance.

Final Thoughts

The rise of MT5 has revolutionized the way traders approach the financial markets. With its comprehensive analytical tools, advanced order management capabilities, and support for automated trading, the platform has become a go-to choose for traders across various asset classes.

Through the power of MT5, traders can enhance their market research, develop more informed trading strategies, and potentially gain a competitive edge in the dynamic world of trading. As the financial landscape continues evolving, the MT5 platform remains at the forefront of innovation, empowering traders to navigate the markets confidently and precisely.