Kenya’s lively and swiftly expanding forex trading environment presents many opportunities for amateur and professional traders. Since the sector is evolving rapidly and offers an increasing diversity of options, selecting a reputable, preferably regulated forex broker is crucial to achieving your trading targets and securing your investments in safe trading.

In this article, we concentrated on the legislative framework concerning forex trading in Kenya, the top forex brokers in Kenya, and the key steps to be completed before embarking on a forex journey.

Contents

- 1 Is Forex Trading Legal in Kenya?

- 2 CMA’s Regulatory Functions for Forex Brokers

- 3 Pros & Cons of Trading with a CMA-regulated Broker

- 4 How to Know if Your Forex Broker is Regulated

- 5 Getting Started with Forex Trading in Kenya

- 6 Forex Trading Tips for Success

- 7 Educate yourself

- 8 Start small

- 9 Use risk management tools.

- 10 Keep a trading journal.

- 11 Stay informed

- 12 Practice patience

- 13 The Path to Profits

Is Forex Trading Legal in Kenya?

Forex trading is legal in Kenya. Although Kenya is considered an emerging market, it has quite a strict regulatory landscape for online retail Forex CFD trading. Kenya developed a legal framework for local regulation in 2017, with the scope of traditional financial regulator Capital Markets Authority enforcing the regulation. Moreover, unlike most of its peers, Forex brokers with a physical presence in Kenya are subject to the CMA regulation and must obtain a license, which is highly regulated, as in Europe and the UK.

These regulations are crucial for protecting traders in several ways:

- Operating and reserve capital requirements ensure traders can recover their funds during a broker’s bankruptcy.

- Leverage restrictions prevent beginner traders from losing all their money while still learning the ropes.

With so many companies now operating on the forex market, it can hard be hard to know which forex brokers offer the best online trading experience. Here is a list of some of the most popular brokers among Kenyan traders:

Broker | Features | Broker Review | Visit |

* 1:1000 leverage * 210+ instruments * Free education | |||

* 1:500 leverage * 800+ instruments * African Broker | |||

* CMA regulated * 1:400 leverage * 66 forex pairs | |||

* CMA regulated * 1:1000 leverage * 1200+ instruments | |||

* CMA regulated * 1:500 leverage * 1000+ instruments | |||

* 1:1000 leverage * 950+ instruments * Copy trading | |||

*1:500 leverage |

CMA’s Regulatory Functions for Forex Brokers

As outlined in the Capital Markets Act, the various regulatory functions include:

- Licensing and supervising all capital market intermediaries

- Ensuring compliance with the legal and regulatory framework by all market participants

- Regulating public offers of securities, such as equities and bonds, and the issuance of other capital market products like collective investment schemes

- Promoting market development through research on new products and services

- Reviewing the legal framework to respond to market dynamics

- Promoting investor education and public awareness

- Protecting investors’ interests

According to section 23 (1) of the Capital Markets Act, “No person shall carry on business as an online forex broker or hold himself out as carrying on such a business unless he holds a valid license issued under this Act or the authority of this Act.”

Pros & Cons of Trading with a CMA-regulated Broker

| Pros | Cons |

| Local protection for trading accounts | Absence of negative balance protection |

| Sufficient operating capital required (at least 50 million KSH) | Lack of a financial compensation scheme |

| Adequate capital reserves required (40 million KSH or 80% of operating capital) | Restricted leverage (1:400 for non-finance professionals) |

| Controlled leverage to minimize risk | |

| Local currency (KSH) trading accounts available | |

| Efficient and cost-effective transactions (free same-day deposits/withdrawals, eWallet support) |

Traders should carefully weigh these factors when choosing a broker and always prioritize working with reputable, well-regulated entities to minimize risk and ensure a secure trading experience.

How to Know if Your Forex Broker is Regulated

Are you curious if that Forex broker is playing by the rules? The CMA maintains an online search tool that allows users to check for authorized brokers. This tool, https://www.cma.or.ke/, displays the results in a dedicated window. By entering the name of the broker they are interested in, traders can easily determine if that entity holds a valid CMA license.

Suppose your broker’s name appears; congratulations! They’ve earned the CMA’s stamp of approval and are regulated to the nines. But if their name are nowhere to be found, you might want to think twice before entrusting them with your hard-earned cash. With this transparency trick, the CMA makes navigating Kenya’s Forex scene easier.

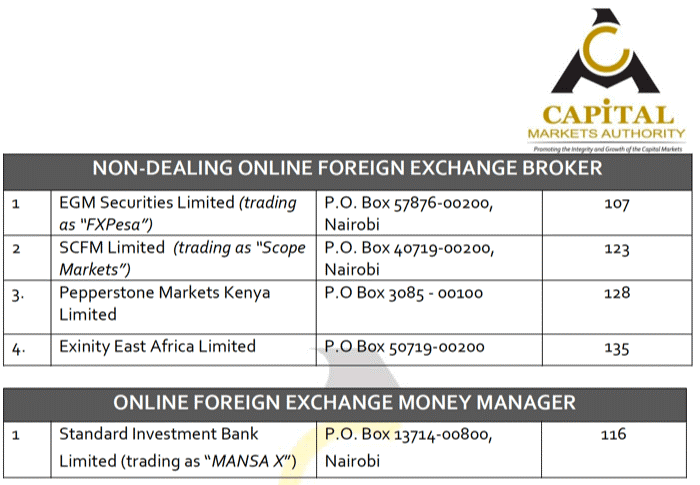

This is what your results should look like:

Getting Started with Forex Trading in Kenya

Embarking on your forex trading journey in Kenya is a straightforward process. Follow these steps to set up your account and begin trading:

- Research and choose a reputable, trustworthy broker that is CMA-licensed and offers all you need as a trader.

- Fill out the broker’s account application form, carefully read and understand all the terms and conditions.

- Deposit funds into your account using a payment method that works for you; bank transfers and e-wallets are usually ideal. More importantly, only invest money you will lose, as trading carries some risk.

- Practice trading using the broker’s trading platform and create a demo account. A demo account allows you to simulate trades without actual money.

- Envision your trading with a well-defined plan – include where you will enter and exit a trade, how you will manage risk, and targeted gains.

- Finally, place a trade – select the position size and buy or sell on a currency pair you choose as per your trading plan.

You should constantly review your trading performance and adjust your profits, take, and risk management strategies. You should also keep in touch with market developments and economic occurrences that could impact currency prices globally.

Forex Trading Tips for Success

Educate yourself

Invest time learning about forex market dynamics, technical analysis, and fundamental factors affecting currency prices. Many brokers offer free educational resources, webinars, and tutorials to support your growth.

Start small

As a beginner, focus on trading a single currency pair and gradually expand your portfolio as you gain experience and confidence. Avoid overextending yourself by trading multiple pairs simultaneously.

Use risk management tools.

Employ stop-loss orders to limit potential losses and protect your capital. Consider using a risk-reward ratio of at least 1:2, aiming for profits to double your potential losses.

Keep a trading journal.

Document your trades, including entry and exit points, position sizes, and market conditions. Review your journal to identify patterns, learn from mistakes, and refine your strategies.

Stay informed

Monitor economic calendars, news releases, and geopolitical events that can trigger market volatility. Adapt your trading plan to capitalize on opportunities while managing risk during turbulent periods.

Practice patience

Avoid impulsive trades driven by fear or greed. Stick to your trading plan, wait for high-probability set-ups, and be prepared to walk away if market conditions are unfavorable.

The Path to Profits

It takes hard work and a commitment to continuous improvement to make consistent profits in forex trading. Here are several strategies to follow as you grow:

- Diversify your portfolio: Over time, add more currency pairs and other asset types, such as commodities or equities, to diversify risk and take advantage of new opportunities across multiple markets.

- Leverage advanced tools: Experiment with custom indicator settings, expert advisors, and charting software to improve your analysis and decision-making capabilities.

- Collaborate with others: Find trading communities, forums, and social media communities where traders gather to share ideas, learn from successful traders, and get fresh insights into the market’s work.

- Adapt to changing conditions: Frequently analyze your trading set-up and adapt to new market dynamics and changes in the broader environment, including economic events and new laws and regulations.

- Prioritize emotional control: Be disciplined, patient, and objective in your trading approach. Never let emotions cloud your judgment, and always try to execute your plan by it.

Kenya’s dynamic forex market could be your key to unlocking your financial dreams if you choose a reputable, CMA-regulated broker. Learn continuously and apply robust risk management methods. However, always be aware that forex trading is tricky; successful trading necessitates commitment, skill, and ethical behavior.

Check out our list of Best Forex Brokers with Low Spreads.